Chapter III.

Greenspan Conundrum and Bernanke Global Saving Glut.

Paragraph 7: Systemic Risk.

it is not too soon for policy-makers to begin thinking about the reforms to the financial architecture, broadly conceived, that could help prevent a similar crisis from developing in the future.

We must have a strategy that regulates the financial system as a whole, in a holistic way, not just its individual components. In particular, strong and effective regulation and supervision of banking institutions, although necessary for reducing systemic risk, are not sufficient by themselves to achieve this aim.

First, we must address the problem of financial institutions that are deemed too big--or perhaps too interconnected--to fail.

Second, we must strengthen what I will call the financial infrastructure--the systems, rules, and conventions that govern trading, payment, clearing, and settlement in financial markets--to ensure that it will perform well under stress.

Third, we should review regulatory policies and accounting rules to ensure that they do not induce excessive procyclicality - that is, do not overly magnify the ups and downs in the financial system and the economy.

Finally, we should consider whether the creation of an authority specifically charged with monitoring and addressing systemic risks would help protect the system from financial crises like the one we are currently experiencing.

My discussion today will focus on the principles that should guide regulatory reform, leaving aside important questions concerning how the current regulatory structure might be reworked to reduce balkanization and overlap and increase effectiveness.

I also will not say much about the international dimensions of the issue but will take as self-evident that, in light of the global nature of financial institutions and markets, the reform of financial regulation and supervision should be coordinated internationally to the greatest extent possible."

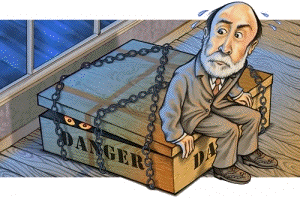

Chairman Ben S. Bernanke

Financial Reform to Address Systemic Risk.

At the Council on Foreign Relations, Washington, D.C.

March 10th, 2009

Abstract:

Since the subprime meltdown the public has discovered an enormous risk he was taking but never knew about: the systemic risk. The problem is that most of our economic leaders have at best an imprecise knowledge or a vague notion of it and at worst, and that is most worrying, have no idea of its nature.

I am first going to define what it is and then in the following paragraphs I will show that our economic leaders have no idea of what they are talking about!

In the following paragraph I will take two examples: Alan Greenspan as someone who best understands systemic risk, and Ben Bernanke (yes the guy that wants to regulate it!) as someone that least understands it.

Systemic Risk:

In Finance:

A systemic risk is a risk that can't be diversified away by simply investing in a risk-free asset. The reference is the Market risk, which is compensated for by a risk premium, which is the amount over a risk-free rate.

There are only two systemic risks: increase of interest rates and the Liquidity Trap.

I will show also that in fact the only systemic risk there is, is the Liquidity Trap, because in any other case you don't become bankrupt because you over-leveraged your (diversified) portfolio will over a short period of time to recover its previous value and even make a nice return for you. The Greenspan Put covers it. Its macro economic consequences are small if any.

The Liquidity Trap is the only systemic risk that cannot be protected. The buy and hold strategy is definitely not an option. Its economic consequence are catastrophic and long-term. [Confer Chapter III: Greenspan Conundrum and Bernanke Global Saving Glut.; Paragraph 3, Bubbles & Bursts.].

The return on investments is, according to the Capital Asset Pricing Model made of two parts a risk free rate and a risk premium,. That risk premium is the sum of a systemic risk premium and a risk free interest rate.Â

I have showed that that premium was the Market reward for interest rate risk of the said security.

The expected return for the non systemic risk is zero (Market does not reward for taking diversifiable risk.)

The systemic risk premium is, we have seen, Market reward for interest risk, which I showed, is the time value of an option.

In a Liquidity Trap, the only true systemic risk there is, the bank and financial institutions must be rescued by the central banks and governments.

Why are the banks rewarded with a systemic risk premium? Simply for taking a risk they can't assume!

In Economy:

It is the risk that the output of the system will vary over time. We are not concerned about the upside risk but obviously we are concerned about downside risk.

Like before if there is a variation monetary or fiscal policy can counter that risk, it is not a systemic risk in the sense that we can insure against it if our policy makers take the right decision.

It is not a surprise that Alan Greenspan brought the world 18 years of sustained growth and under his management every financial crisis had a minor impact on economic output. He had the tools and knew how to use then.

The cyclical behavior of the economy before his tenure was due to Volcker's catastrophic conduct of the monetary policy [Confer Chapter V The Myth of Inflation.: Paragraph 3, The Stagflation Paradox.] and the dismal behaviour of his predecessors [Confer Chapter V: The Myth of Inflation.; Paragraph 3, The Barbaric Relic.].

In fact the sub prime crisis was not due to a systemic risk but due to the catastrophic policy of Bernanke as he continued the policy of high short-term rate started by Greenspan and inverted excessively the yield curve. For that problem to be solved we need simply to remove Bernanke.

The only systemic risk there is if the output goes down dramatically and can not be fixed.

It is the case we will see in Chapter VII: Economic Policy in a Depression. there is nothing that can be done in the case of the Liquidity Trap.

A

systemic risk is due to the system and no one in the system can correct

it because if someone could obviously it wouldn't be a systemic risk!

In order to fix it you would need to be outside the system, which is

impossible. The only option that is left is to change the system.

Systemic Regulator:

In order to calm your angst our leaders have invented the concept of a systemic risk regulator. that would prevent the return of a Crash. However with what we now know about the systemic risk the sheer idea that you would create a systemic risk regulator is akin to believe that Santa Klaus will bring the game of your dream. It is a nice dream that help you live in dire times, it will never come true.

It is worse than loto. When you play lottery you have one chance in several millions to win here you have none!

Systemic Entities:

Bernanke in order to justify the presents he made to the financial institutions and terrorize you at the perspective of not doing it call the corporations of his buddies systemic entities.

It is true that in order for the capitalist economy to function the credit market must be functioning. However should all the banks fail, if providing credit was profitable other entity would arise and provide the service. It is creative destruction it is valid for your job, for your company, for your couple, there is no reason that it wouldn't be valid for the financial companies and this no matter how large they are. There is no such a thing as a systemic entity or we are all systemic: no one is indispensable. Cemeteries are full of the graves of indispensable people and corporations:

Â

"Combien, de nos chairs se repaissent mais si les corbeaux,

les vautours un de ces matins disparaissent le soleil brillera toujours."

Eugà �ne Pottier

18161887

L'Internationale.

June 1871

There is no one cause of Systemic Risk: in a system there is no cause and consequence. The cause is the consequence of its consequences and the consequence is the cause of its causes. Trying to look for a cause and a consequence in a system is overlooking its true nature.

The systemic risk is endogenous to the system. Nothing can be done within the system to avoid it or cure its consequences.

All of This Stays True Until the Poor Becomes Richer Relatively to the Rich.

My Political Orientation According to Nolan Chart Survey!

As Libertarian as Friedrich August von Hayek!

Extreme Economic Conditions Call for Radical Solutions.

The Provocative & Controversial Innovation

Since John Maynard Keynes and Friedrich August von Hayek.

It is of the Uttermost Importance That, When the Crash Comes, Which It Will Inevitably Do, we Restore as Fast as Possible the Economy by Implementing our Plausible Alternative Solution as to Minimalize the Economic Sufferings of the People. To That Order I am Building Redundant Social Networks. Please Grow the Networks!

You Can Comment on This Chapter Here.

I Will Incorporate Any Meaningful Contribution Into my Tract and Credit the Author.

If you Believe you can Make a Significant Contribution to my Work Please Apply Here.

Read the Publisher Agreement.

The Tract will be ready to go to for edition on September 1st, 2009. I am looking for an editor.