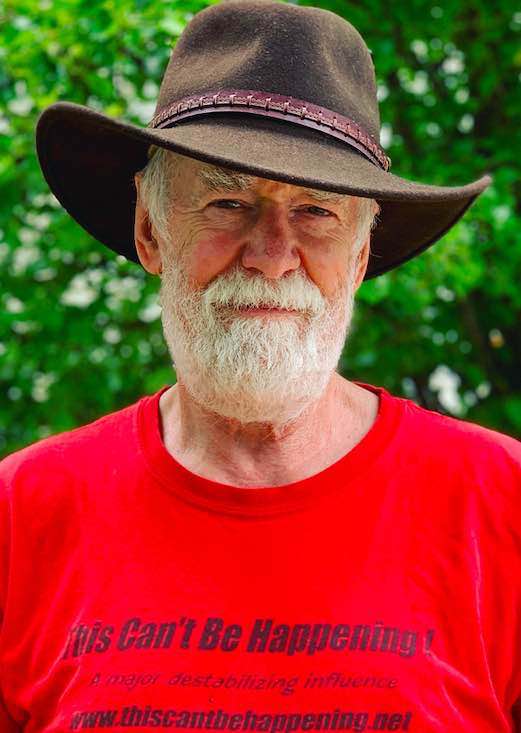

By Dave Lindorff

The one thing we are not hearing from Congress or from incoming president Barack Obama in the current economic crisis facing the country are the words “anti-trust” and “public ownership.”

From the moment the crisis first struck, with the near collapse of AIG, the mantra has been that companies like AIG, Morgan Stanley, Merrill Lynch, Citibank, etc.--and more recently General Motors Corp. and Ford--are “too big to fail.” That is, it is argued that these companies are so huge that if they were to collapse into the rubble they deserve to be, it would damage the nation irreparably.

The question is, if that is genuinely the case, why were they allowed to be that big in the first place, and why aren’t we rethinking that policy?

It’s not as though they got that way through organic growth by being successful at what they did. Hardly. GM was the quintessential result of a merger of smaller automakers. Ford grew too, by acquiring the competition, most recently Volvo. Most, if not all of those acquisitions were first vetted and approved by the Federal Trade Commission and found to be acceptable as a matter of economics and public policy.

In the banking industry, which is regulated, the picture is even worse, with the government first opening the door to the creation of national banking companies, and then routinely approving the gobbling up of one after another regional or even national bank by another. At some point we reached the point where the giants in the industry—Citibank, JP Morgan Chase, Bank of America, Wells Fargo, etc.—were able to say, when they ran into trouble, that allowing them to fail would have dire consequences for the national economy. This kind of extortion should never have been allowed to happen.

First of all, the argument for national banks never made sense for ordinary people, and wasn’t necessary for large customers either. Large corporate fundings have always been done by bank consortia, and this could have been accomplished with the nation’s banking industry fragmented into small state-chartered institutions. Meanwhile, small businesses and individuals always lose when a bank is national in scale. It is much more costly to handle the banking business of small enterprises and individual families than it is to handle the business of huge corporate clients, with the result that the major banks have made it costlier and costlier for small customers to do business with them.

The answer is clear. Bigness is fundamentally bad when it comes to capitalism. There is a point where any company in any industry becomes too big for it to be socially acceptable. Big companies not only attempt to behave in a monopolistic fashion by destroying or buying up the competition, both nationally or, as in the case of a retailer like WalMart or a bank like Citibank, locally, using their huge financial power to locally underprice the competition and drive them out of business (after which they are free to gouge the local customer base). They also ride roughshod over local political interests, demanding tax breaks, zoning waivers, etc. This being the case, the government should simply not be allowing corporations to achieve such scale and market dominance.

Companies, whether banks, car makers, or media companies, should never be allowed to grow to a point that they become “too big to fail.” If that can be said about any company, whether because of the assets it holds, or because of the number of people it employs, it is time to break it up.

Think of GM. If GM were ripped up into six or seven competing companies, it is certain that at least one of those smaller entities would be producing electric cars by next year. The Saturn plant already made one, the Impact, that was wildly popular (see the excellent documentary “Who Killed the Electric Car”), and if left to its own devices to sink or swim, could probably be cranking those out in volume for the 2010 model year.

Some companies would certainly fail. But that’s what is supposed to happen in a capitalist system.

This piece is not meant to be a paen to capitalism. But having said that, if you’re going to have capitalism, which is the ruling ideology here in the US of A, you have to let it function as intended. As soon as the government comes in and starts encouraging the establishment of monopolies or quasi-monopolies, and preventing the failure of poorly managed enterprises or dying industries, as it is doing in the case of the banking and automotive sectors, it is no longer true capitalism.

That could work, too. Many democratic countries, including Japan, Sweden, France and Germany, have the concept of shared governance of corporations, in which large corporate entities are partially owned and run by government, and of planned economies, in which certain sectors are deliberately protected and promoted by government policy. The US has moved in that direction with the investment by the government in nine of the country’s largest banks, and in discussions to provide $25-50 billion in financial assistance to the major US auto companies. But in the US case, the government is studiously avoiding demanding a role in running those companies. It is by design only a “passive” investor.

This is the triumph of ideology over rationality and the public interest. I recently interviewed a number of investment strategists in the course of working on an article for an investment magazine. They all had the same advice for worried investors: invest in shares of the “magic nine” banks that are recipients of tens of billions of dollars in bail-out money from the federal government. As they all point out, the government’s stake in these banks means that they will not be allowed to fail, and moreover, they are in a unique position to use their flush capital reserves to acquire, at fire sale prices, the assets of smaller banks that are being left to sink or swim in the current credit crisis and recession. That is not a free market. It’s a government program to reduce the competition in the banking sector and hand all the business over to a favored few giant banks.

Now that would be okay if the government, in return for its investment, were taking a management role in those favored banks. But it is not. Congress, the Bush administration, and, so far at least, the incoming administration of Barack Obama, have not been demanding a management stake in any of the companies that are getting bail-out funding. If the government takes ownership positions at all, it is taking non-voting shares in those companies, solely in the hope of someday getting some of the invested money back by selling those shares.

This is not just a rip-off of the taxpayer. It is a craven program to enrich big investors in the bailed-out enterprises, while putting control of the nation’s economic destiny increasingly into a smaller number of hands of people whose interests are not even aligned with the national intereest (these are, after all, all transnational corporations only nominally headquartered in the US).

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).