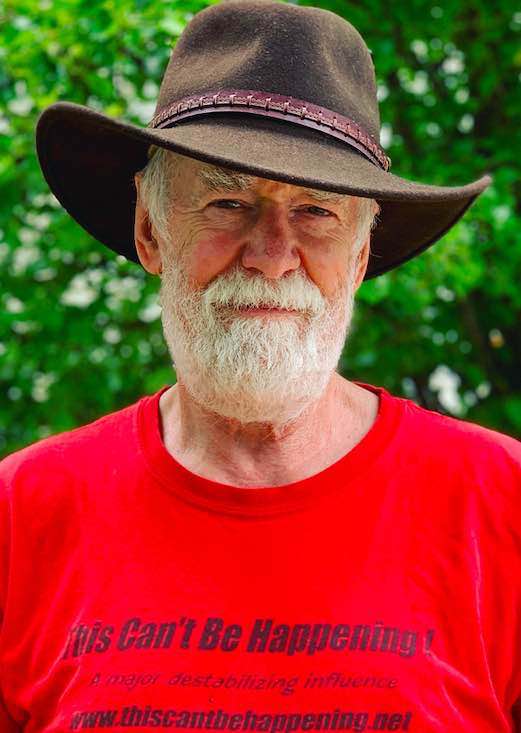

By Dave Lindorff

George Santayana once famously said, “Those who cannot learn from history are doomed to repeat it.” But what about those who don’t just ignore history, but who hire and take counsel from those who committed historic follies in the past?

Back in November 1999, Congress passed legislation pushed by then Sen. Phil Gramm (R-TX), rescinding the Depression-era Glass-Steagall Act. The measure, backed by the Clinton administration, and overwhelmingly passed by the Senate (90-8) and the House (362-57), opened the way for banks to merge with investment banks and insurance companies, and led directly to the current financial cataclysm.

A report on that Congressional action written by reporter Stephen Labaton and published in the New York Times on Nov. 5, 1999 under the headline “Congress Passes Wide-Ranging Bill Easing Bank Laws,” includes some remarkable quotes from key players in that sellout to the financial sector.

Here’s Larry Summers, a chief architect of the current financial industry multi-trillion-dollar bailout giveaway being orchestrated by the Obama administration, where he serves as director of President Obama’s National Economic Council:

''Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century. This historic legislation will better enable American companies to compete in the new economy.''

And here’s what Sen. Charles Schumer (D-NY), awash in Financial industry campaign donations but currently in high dudgeon over the Wall Street’s bonus payments to executives, speaking about the ’99 measure eliminating Glass-Steagall:

''If we don't pass this bill, we could find London or Frankfurt or years down the road Shanghai becoming the financial capital of the world. 'There are many reasons for this bill, but first and foremost is to ensure that U.S. financial firms remain competitive.”

The article quotes the Clinton administration and Summers’ Treasury Department as predicting that revoking Glass-Steagall and permitting banks to expand into investment banking and insurance would save consumers “$18 billion a year” through economies of scale—a figure that seems rather quaint as taxpayers now pony up trillions of dollars to rescue those same institutions. (The article notes that critics of deregulation argued that even those paltry savings, probably overstated, would flow to financial sector investors, not to consumers.)

The old Times clip (brought to my attention by alert veteran radical writer and activist Bert Schultz of Philadelphia), does highlight a couple of prophetic heroes, too.

Sen. Byron Dorgan (D-ND), one of seven Senate Democrats who voted against revoking Glass-Steagall, said:

“I think we will look back in 10 years' time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930's is true in 2010. I wasn't around during the 1930's or the debate over Glass-Steagall. But I was here in the early 1980's when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness.''

And then there’s the late Sen. Paul Wellstone (D-MN), who died in a tragic and still unexplained plane crash during his campaign for re-election in 2002. Congress, he said, seemed:

“…determined to unlearn the lessons from our past mistakes. Scores of banks failed in the Great Depression as a result of unsound banking practices, and their failure only deepened the crisis. Glass-Steagall was intended to protect our financial system by insulating commercial banking from other forms of risk. It was one of several stabilizers designed to keep a similar tragedy from recurring. Now Congress is about to repeal that economic stabilizer without putting any comparable safeguard in its place.''

For the record, also voting against Glass-Steagall repeal in the Senate were lone Republican Richard Shelby of Alabama, and six other Democrats: Barbara Boxer (CA), Richard Bryan (NV), Russ Feingold (WI), Tom Harkin (IA), and Barbara Mikulski (MD). 51 Democrats, 5 Republicans and 1 independent voted against the measure in the House.

Treasury Secretary Tim Geithner, a key player in the current bailout scheme, isn’t mentioned in the Times article about Glass-Steagall, but at the time was a protégé of Summers, working as undersecretary of the treasury for international affairs.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).