American consumers do not want the Age of Mammon to end. They will need to be dragged kicking and screaming into the Age of Austerity. Consumer expenditures peaked at $10.2 trillion in the 3rd Quarter of 2008. They reduced spending for two quarters, but when Big Daddy Government handed them billions and told them to spend it on cars, appliances, and homes, they dutifully obeyed. Today, consumer expenditures stand at an all-time high of $10.3 trillion, still accounting for 70.5% of GDP. There really has been no hint of austerity by Americans. It is a false storyline. The major reductions in consumption still loom in the future.

The myopic financial "experts" have no sense of history or the concept of reversion to the mean. They didn't get it with home prices and they don't get it with consumer expenditures. The country has been on a 30 year drunken binge of debauchery, debt accumulation and delusions of never ending 10% annual home price gains funding a glorious 30 years of retirement on an island in the Caribbean. These visions of a sugar plumb life of leisure are slowly giving way to the nightmare scenario of eating cat food in your very own cardboard box McMansion. The bombastic Boomers are turning 50 years old at a rate of 10,000 per day. A staggering 38% of workers between the ages of 45-54 have less than $10,000 of retirement savings and a mind boggling 29% of workers over 55 have less than ten grand in their retirement savings, according to the Employee Benefit Research Institute. It is no longer a matter of people deciding whether to save, it is a matter of saving or else living in abject poverty in their old age.

In the good old days, before the advent of the credit card in 1969, Americans saved up to buy a house, a car, or an appliance. Consumer expenditures as a percentage of GDP stayed in a range of 61% to 64% from 1960 until 1980. This range was reflective of a balanced economy that provided good paying wages to blue collar workers who produced products that were sold in the US and in foreign countries. What a concept. America ran a trade surplus. The financial industry did not drive the economy, they provided financing for businesses that wanted to grow and produce. Sounds quaint. As the Boomers entered their 30s in the early 1980s the easy credit delusion, promoted by Wall Street and the mainstream marketing machine, convinced the spoiled materialistic Boomers that wealth was measured in cool stuff rather than accumulated savings invested over time. Consumer spending as a percentage of GDP surged from 62% to 70% over the next two decades.

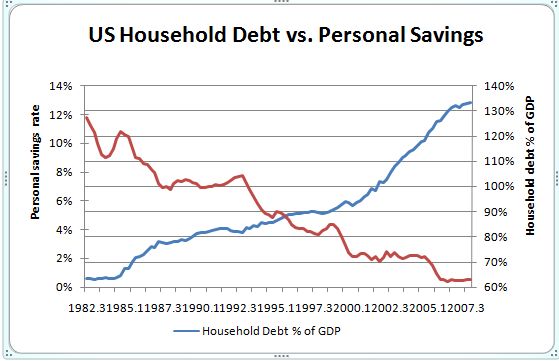

Real wages have been stagnant since the early 1970s. With moribund wage growth there was only one way for Boomers to live the faux American Dream Borrow to the hilt. And borrow they did. The personal savings rate fell from 12% in the early 1980s to below 2% in 2007. The concept of deferred satisfaction was cast aside by the "no worries" Boomers. Saving and frugality was for the Depression era old fogies. The old timers didn't understand modern finance. Why wait until tomorrow when you can have it today by just whipping out a plastic card? The delusion of debt based "wealth" grew for 25 years, encouraged and stimulated by Alan Greenspan and his bubble blowing machine.

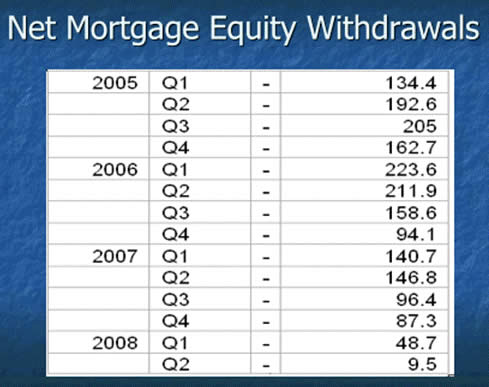

The debt party reached its apex between 2005 and 2007. Boomers willfully ignored or chose to not comprehend the concept of reversion to the mean. They believed with all their hearts that their homes would appreciate at 10% per year for all eternity. To prove their faith in this belief, they used their homes like an ATM and withdrew $1.9 trillion of "equity" between 2005 and 2007 and spent it on 2nd homes, cars, boats, flatscreens, vacations, home theaters, and other assorted must have doo dads. They borrowed against their homes at the absolute peak in home prices. Prices have fallen 30% from the peak, with some markets down 50%. This has left millions up to their eyeballs in debt. The home ATM flashes "INSUFFICIENT FUNDS" when they attempt a withdrawal today.

So here we stand, two years after the financial system collapsed. Government stimulus has provided an artificial boost to GDP. They have tried every trick in the book to convince Americans to keep consuming at a rate higher than they are earning. It is failing because consumers have been shaken from their materialistic stupor. They are slowly coming to the realization that they must save or they will suffer greatly in the next 30 years. The savings rate has been moving erratically higher and is now in the range of 5% to 6%. Ideally, it would need to reach 14% in order for Americans to save enough to cover their retirement. This will never happen. Americans will cut back but they will not revert to the frugal ways of their grandparents.

The GDP of the country is $14.5 trillion. Over the next decade consumer expenditures as a percentage of GDP will fall from 70% to 65% because it must. With stocks destined to return 5%, bonds yielding 2.5% and no equity left in their houses, consumers have no choice. The annual reduction in consumer expenditures will be north of $700 billion. The annual disposable personal income of Americans is $11.3 trillion. The savings rate is 6%. It will rise to 10% over the next few years. This would be $450 billion more savings and $450 billion less spending. This will not happen overnight. It will take at least a decade. Mass delusion wears off slowly and one person at a time. Charles McKay summed up the last 30 years in two quotes from his book Extraordinary Delusions and the Madness of Crowds, written in 1841.

"Money, again, has often been a cause of the delusion of the multitudes. Sober nations have all at once become desperate gamblers, and risked almost their existence upon the turn of a piece of paper."

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one."

Does this paint a picture of an economy roaring ahead? We have at least a decade of low or no growth ahead. Deleveraging after the biggest debt party in history is really a b*tch. The industry which is about to be dealt a mortal blow is the retail industry.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).