Not a coin, a virus

Tsipras' claim that Greece can keep the euro while rejecting austerity is crazy-talk. The fact is that German Chancellor Angela Merkel, the Cruella De Vil of the Eurozone, will ignore the cries of the bleeding Greeks and demand we swallow austerity--or lose the euro.

But, so what if we lose the euro? The best thing that can happen to Greece, and should have happened long, long ago, is that Greece flee the Eurozone.

That's because it is the euro itself that is the virus responsible for Greece's economic ills.

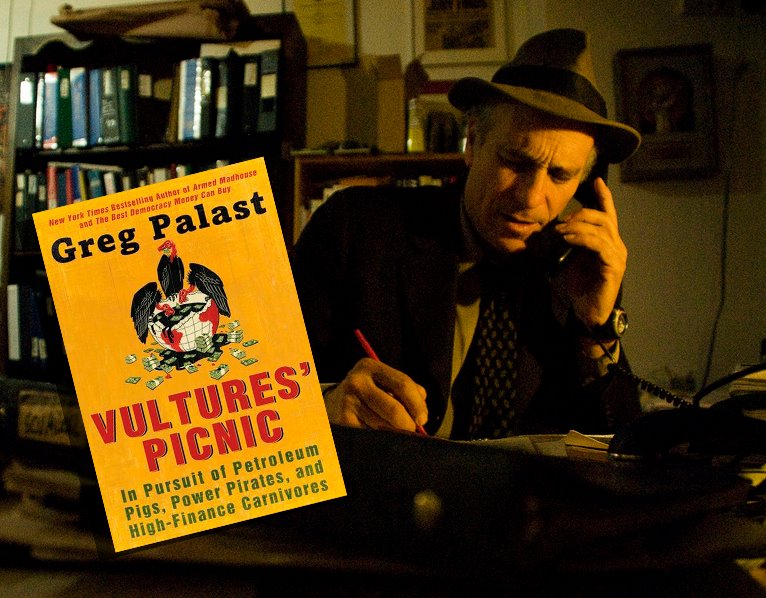

Indeed, the sadistic commitment to "austerity" was minted into the coin's very metal. We're not guessing. One of us (Palast, an economist by training) has had long talks with the acknowledged "father" of the euro, Professor Robert Mundell. It's important to mention the other little bastard spawned by the late Prof. Mundell: "supply-side" economics, otherwise known as "Reaganomics," "Thatcherism" -- or, simply "voodoo" economics.

The imposition of the euro had one true goal: To end the European welfare state.

For Mundell and the politicians who seized on his currency concept, the euro itself would be the vector infecting the European body politic with supply-side Reaganomics. Mundell saw a euro'd Europe as free of trade unions and government regulations; a Europe in which the votes of parliaments were meaningless. Each Eurozone nation, unable to control neither the value of its own currency, nor its own budget, nor its own fiscal policy, could only compete for business by slashing regulations and taxes. Mundell said, "[The euro] puts monetary policy out of the reach of politicians" Without fiscal policy, the only way nations can keep jobs is by the competitive reduction of rules on business."

Here's how it works. To join the Eurozone, nations must agree to keep their deficits to no more than 3% of GDP and total debt to no more than 60% of GDP. In a recession, that's plain insane. By contrast, President Obama pulled the USA out of recession by increasing deficit spending to a staggering 9.8% of GDP, and he raised the nation's debt to 101% from a pre-recession 62%. Republicans screamed, but it worked. The US has lower unemployment than any Eurozone nation.

As Obama scolded the European tormentors of Greece: "You cannot keep on squeezing countries that are in the midst of depression." Cutting spending power only leads to less spending which leads to further cuts in spending power -- a death spiral we see today in the Eurozone from Greece to Italy to Spain--but not in Germany.

"Not in Germany." There's the rub. Normally, a nation such as Greece can quickly recover from debt-induced recession by devaluing its currency. Greece would become a dirt cheap tourist destination once more and its lower-cost exports would zoom, instantly increasing competitiveness. And that's what Germany can't allow. Germany lured other European nations into the euro in order to keep them from undercutting Germany's prices in export markets.

Restricted by the 3% deficit rule, the only recourse left for Eurozone debtors: pay the piper with "austerity" measures.

Tsipras in Wonderland

So therein lies the lie. Tsipras tells his fellow Greeks that we can live in a Looking Glass world, where we can have our euro and eat it too; that we can stay handcuffed to the euro but run free without austerity.

The nonsense continues: Following the announcement of the official results of the referendum on Sunday night, Tsipras tweeted that the Greek electorate voted for a "Europe of solidarity and democracy," while the now-resigned finance minister Varoufakis tweeted that "Greece's place in the Eurozone is non-negotiable," claiming that he would not allow the "only alternative," the old drachma trading alongside the euro.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).