- Richard Nixon Takes U.S. off Gold Standard

After World War II a Gold Standard was established by the Bretton Woods Agreements. Under this system, many countries fixed their exchange rates relative to the US dollar. The US promised to fix the price of gold at $35 per ounce. Implicitly, then, all currencies pegged to the dollar also had a fixed value in terms of gold. Alan Greenspan argued in 1966 that,

under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth… The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit… In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.

Under the regime of the French President Charles De Gaulle, France reduced its dollar reserves, trading them for gold from the U.S. government, thereby reducing US economic influence abroad. This together with the fiscal strain of the Vietnam War led President Richard Nixon to eliminate the fixed gold price in 1971. The U.S. dollar has lost 93% of its purchasing power since 1971. The welfare statists have confiscated middle class savings through inflation while being aided and abetted by Alan Greenspan and the Federal Reserve.

- China Embraces Capitalism

The process of economic reform began in earnest in 1979, after Chinese leaders concluded that the Soviet-style system that had been in place since the 1950s was making little progress in improving the standard of living for Chinese citizens and also was failing to close the economic gap between China and Western nations. The reforms of the late 1980s and early 1990s focused on creating a pricing system and decreasing the role of the state in resource allocations. The reforms of the late 1990s focused on closing unprofitable enterprises and dealing with insolvency in the banking system.

After the start of the 21st century, increased focus has been placed on narrowing the gap between rich and poor in China. The huge influx of peasants from the countryside to the cities led to a manufacturing boom in China and the gutting of manufacturing in the United States. The feedback loop of Americans borrowing at low rates and spending on Chinese made goods while China kept buying US Treasuries, which kept U.S. interest rates low, has led to an unsustainable boom that has now gone bust. Allowing this unsustainable trend to grow beyond all reasonableness is now leading to social unrest in China.

- Greenspan Put

Alan Greenspan in his role as Federal Reserve Chairman attempted to solve every financial crisis by lowering interest rates and increasing liquidity. It began when he came to the rescue after the stock market crash of 1987. The Fed did the same thing after the Gulf War, the Mexican crisis, the Asian crisis, the LTCM implosion, Y2K, the bursting of the Dot Com bubble, and the 9/11 tragedy. Investors became convinced that Greenspan would always come to the rescue and keep stock prices from falling. This belief caused investors to take much greater risks and led to the colossal overleveraging that took place between 2000 and 2008. The artificial perception of safety led to the worst financial crisis in history. Ben Bernanke is now following in Greenspan’s footsteps.

- U.S. Maintains Military Base in Saudi Arabia after Gulf War

Osama Bin Laden returned to Saudi Arabia in 1990 as a hero of jihad, who along with his Arab legion, "had brought down the mighty superpower" of the Soviet Union in Afghanistan. During this time frame Iraq invaded Kuwait and Bin Laden met the Crown Prince of Saudi Arabia, and told him not to depend on non-Muslim troops and offered to help defend Saudi Arabia. Bin Laden was rebuffed and publicly denounced Saudi Arabia's dependence on the US military.

After the 1st Gulf War, the U.S. with the support of the Saudi rulers allowed a permanent U.S. military base in Saudi Arabia. This presence led Bin Laden to declare a jihad against the U.S. infidels and eventually led to the 9/11 attack and the War on Terror. This has led to mammoth budget deficits, thousands of unnecessary American and Iraqi deaths, and contributed hugely to the financial crisis of 2008.

- 9/11 Attack

The terrorist attack on the World Trade Center killed almost 3,000 Americans and provided President Bush with worldwide support to capture or kill Osama Bin Laden and his supporters. The U.S. successfully defeated the Taliban and cornered Bin Laden in the mountains of Afghanistan. The Bush administration declared a War on Terror, invaded Iraq on false pretenses wasting the lives of 4,500 Americans and damaging the lives of 30,000 Americans who were wounded, wasted $800 billion of borrowed taxpayer money, created the Department of Homeland Security at a cost of $50 billion per year, tortured captives, and has allowed the government to monitor private conversations of Americans without a warrant. An attack by 19 men with knives has led to the decline of the United States stature throughout the world and pushed the U.S. towards bankruptcy. The beacon of freedom has seen its light dim.

- SEC Takes Deregulation to Heart

Alan Greenspan and the free market ideologues in the Bush administration thought that no regulation was the best policy for the financial markets. They believed that markets would regulate themselves. This led to non-enforcement of existing rules and regulations. The SEC waived the 12 to 1 leverage ratios for the five biggest investment banks. Those banks then leveraged 40 to 1 and collapsed the worldwide financial system. The SEC failed to catch the Enron and Worldcom accounting frauds. The SEC was given indisputable proof that Bernie Madoff was conducting a ponzi scheme as far back as 1999. It ignored the facts and allowed a $50 billion fraud to destroy any remaining trust in the U.S. financial system. The SEC is in the back pocket of Wall Street. Its executives leave the SEC and get million dollar jobs on Wall Street. Non-enforcement of rules is not deregulation it is government corruption and incompetence.

Ignorance, Stupidity, and HubrisSociologist Robert K. Merton popularized the concept of unintended consequences in a paper written in 1936. Some possible grounds for the unintended consequences are the world’s complexity, human stupidity, self deception, hubris and biases. Merton’s five possible causes were:

- Ignorance (It is impossible to anticipate everything, thereby leading to incomplete analysis)

- Error (Incorrect analysis of the problem or following habits that worked in the past but may not apply to the current situation)

- Immediate interest, which may override long-term interests

- Basic values may require or prohibit certain actions even if the long-term result might be unfavorable (these long-term consequences may eventually cause changes in basic values)

- Self-defeating prophecy (Fear of some consequence drives people to find solutions before the problem occurs, thus the non-occurrence of the problem is unanticipated)

Ignorance, error, and immediate interest sound like a perfect motto for the U.S. Congress, Federal Reserve, and Treasury. When media pundits, pompous economists, self proclaimed “experts”, and corrupted politicians assure you that they have the solutions to all of our problems they are practicing the most evil form of hubris. The arrogance and self importance of these people is an insult to the intelligence of all Americans. They put their unproven theories into practice by committing trillions of taxpayer funds. They are only concerned about the next election cycle and not about the long-term consequences of their ignorance and ignorance of crucial facts. The accumulation of blunders over the decades by government has led to unintended consequences that could bring down our country. Recent developments will have disturbing consequences for all Americans.

Unintended Consequences of Cheap OilWhen oil reached $147 a barrel in the summer of 2008, panic was setting in among the sages in Congress. Windfall profit taxes on oil companies and government intervention to support alternative energy were the mantra of congressmen and Presidential candidates. Government intervention was going to work its magic. Instead, the markets adjusted rapidly to a worldwide decline in demand and the price plummeted to less than $40 a barrel. This drop has put an additional $200 billion of money back into the pockets of Americans. This was a needed relief in the midst of a grinding recession. The law of supply and demand worked without government intervention. The short-term focus of our politicians and many Americans will likely squander this temporary reprieve.

The pundits concluded that oil reaching $147 a barrel was due to speculators. Once the speculators were forced out, oil prices collapsed. Their view is that this temporary crisis has passed and life will go back to normal. American oil demand declined by 13% in September 2008, but Chinese demand grew by 28%. Auto financing at 0% for five years on SUVs will prevail and all will be well. The ignorance of the true facts by our leaders will lead to a future crisis that will make the current financial crisis seem like a walk in the park. The current economic downturn which has temporarily decreased worldwide demand will end. Oil demand will resume its upward slope, while supply has likely reached its peak. The facts based on exhaustive research by Matt Simmons are:

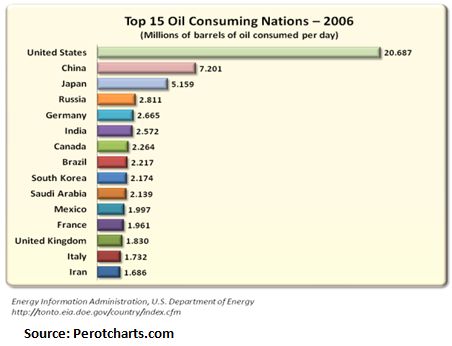

- 60% of the world’s oil is consumed by 10% of the world’s population.

- America represents 5% of the world’s population and consumes 24% of the world’s oil.

- Middle East oil use is growing more rapidly than China’s.

- China now uses 8 million barrels per day versus 3.5 million barrels per day in 1997.

- China now consumes 2 barrels per person versus 24 barrels per person in the U.S.

- The U.S. has 220 million automobiles for 305 million people. China has 32 million cars for 1.3 billion people.

- Peak supply of 86 million barrels of oil per day has been reached. Demand will grow to 115 million to 125 million barrels per day in the next 20 years.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).