Second the QE concerns specific classes of bonds and it is probable that even if they acted on treasuries and MBS the action would be ineffective on corporate bonds and would even widen the spread and increase the perceived risk.

Third the increase in the slope of the yield curve may be interpreted by the Federal Reserve System as a measure of a greater confidence of market participants. (confer above The Yield Curve as a Leading Indicator.)

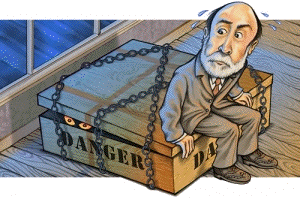

Risk management involves judgement as well as science, and the science is based on the past behavior of markets, which is not an infallible guide to the future.

7, 6, 5, 4 , 3, 2, 1, 0

The clear evidence of underpricing of risk did not prod private sector risk management to tighten the reins.

In retrospect, it appears that the most market-savvy managers, although conscious that they were taking extraordinary risks, succumbed to the concern that unless they continued to "get up and dance", as ex-Citigroup CEO Chuck Prince memorably put it, they would irretrievably lose market share.

Instead, they gambled that they could keep adding to their risky positions and still sell them out before the deluge.Most were wrong.

Facebook:

Events:

The

Market Crash: Be Prepared.

Post

Crash Economy - Economic Non Compliance Week.

Page:

The

Post Crash Economy

Groups:

The Religious Interpretation of Employment, Interest, and Money.

Libertarians Against Credit.

Muslims Against Credit With Interest.

Disclosure: No Positions

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).