Can a "Bank Fair" be a Useful Tool for Increasing Socially Responsible Banking?

By Don Lathrop and Brian Trautman

Discerning shoppers pride themselves on getting a good deal. Yet for people who make decisions regarding their purchases and investments based primarily on principles of fairness and justice, the term "good" is not defined by how much money is saved or earned but by the degree to which a transaction is with a company that operates in a socially responsible and sustainable manner. The banking institutions with which we do business should be held to the same standard. Just as consumers want to know which car dealer is the most honest and which real-estate broker has the most integrity, folks also want to know, especially nowadays, which banking institution upholds the values that are most in line with their own.

It is very doubtful that anyone would mind conducting their banking transactions with George Bailey (as warmly portrayed by Jimmy Stewart in the film classic "It's a Wonderful Life"). And while there is no denying that Stewart's character was a bit idealistic, there surely must be a few banks like his in operation today. Unfortunately, in reality, far too many banks are run by the likes of Bailey's nemesis, Mr. Potter (Lionel Barrymore). In fact, since the repeal of Glass-Steagall in 1999, a number of the commercial banks of Mr. Potter's days have merged with investment firms that are led by speculators and hedgers like Gordon Gekko (a character in the film "Wall Street"), who famously proclaimed, "greed, for lack of a better word, is good. Greed is right, greed works."

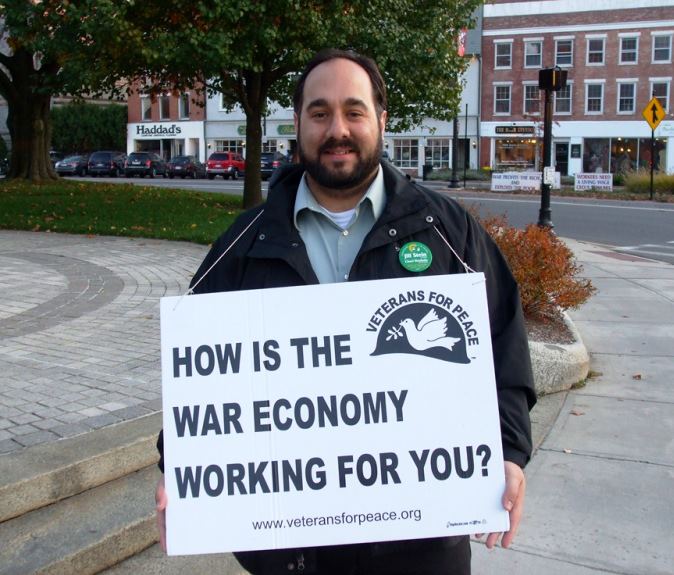

The Occupy Wall Street movement has shown great energy in the streets with its efforts to build class solidarity and let lawmakers and corporations know of the massive disapproval of their activities by 99 percent of the population. The 2008 financial crisis and the Great Recession that followed cost tens of millions of Americans their homes, their jobs or their life savings. The devastating effects of this economic tragedy are as pervasive as they are entrenched, and continue to be felt across America, particularly by the most economically disadvantaged and vulnerable populations.

The birth of the Occupy movement was the result of an urgent need to end the neoliberal economic policies of the last three decades which are to blame for the "too big to fail" financial system and record economic inequality. The tactics of this nonviolent, people-powered movement have included physical encampments as well as other methods of nonviolent direct action, such as sit-ins, teach-ins, flash mobs, rallies, marches, etc. While these approaches should continue, a new activity can involve educating the public about the policies and practices of area banking institutions by occupying a bank or credit union from the inside. In this way, people will acquire the type and level of knowledge that can empower them to increase their level of social responsibility surrounding their money with respect to how and where it is located.

How can ordinary people who want to occupy a banking institution with their money discover one that would make George Bailey proud? This question and more was asked recently of area banking institutions by Berkshire Citizens for Peace and Justice (BCP&J) in an event we called a "Bank Fair." BCP&J believed such an activity would be a fine way to let individuals in need of banking services have an opportunity to compare not only the variety of services offered by county institutions but to learn about the philosophies under which they operate. The Bank Fair was designed to determine 1) the types of products and services area banks and credit unions offer their customers and 2) the nature of their philosophy of operation from an ethical point of view.

As banking is the primary focus of economic power, we considered the Bank Fair to be just the sort of initiative that could provide individuals who were interested in moving toward a more just and equitable society the opportunity to move one step closer by becoming informed about how their choice of banking institution compared to competitors in the treatment of and commitment to customers, community, and the planet. In addition, the Bank Fair was an effort to assist each institution providing banking services in our local communities to make public its special qualities that help it retain its present customer base and encourage new depositors or borrowers.

Below is how we proceeded at BCP&J:

We began with securing an appropriate venue, plus the endorsement of seven area groups, and invited banking institutions located in our county to join us on a Saturday afternoon and set up tables with literature to market their various rates and services, branch and ATM locations, etc. We made the offer at no charge to them. We further indicated this was all they had to do to qualify to be part of this free advertising opportunity. At the same time it was made clear that participating institutions would have an equal amount of time to present their case to the audience for why any area resident would be best off depositing in or borrowing from their institution.

Our invitation further proposed that the participating institutions respond to diverse sets of questions that we thought the audience would be interested in having answered. The basic set of questions was largely of an operational nature, such as: What is the approximate ratio of your cash reserves to the amount of funds you have loaned out? How are your profits distributed? In other words, what percentage goes to stock holders (if you have them), to salaries, to bonuses, to charitable contributions, etc.? Are any "categories" of people excluded from potentially being hired by your firm? What is the ratio of the pay packages of those in your organization who receive the largest ones to those who receive the smallest? Which category of your employees has benefits? What is the nature of those benefits? Do you hold mortgages on homes whose resale value has significantly declined, through no fault of the owner, over the last few years? If so, have you been open to taking any action to offer relief to the borrower(s)? How much money does your institution give to support candidates for political office or to support political parties? Does your institution think it is desirable to reinstate the Glass-Steagall Act?

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).