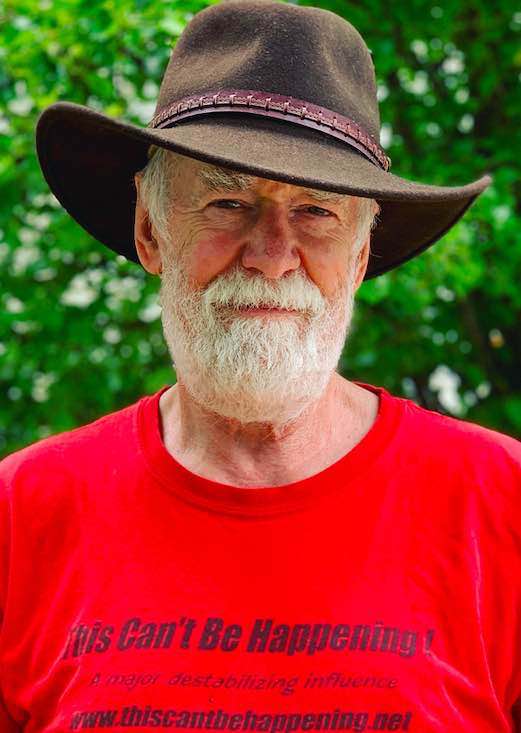

By Dave Lindorff

If Democrats want to come out of this economic crisis with a

powerful mandate to continue running the country, they need to bag the

nonsensical talk of “bi-partisanship” and tackle two big lies that have

been stymieing progressives for decades.

The first lie is that the only solution to the nation’s deepening

health care crisis, which now has over 42 million people—roughly one in

seven Americans—living without any health insurance or ready access to

medical care, is a combination of limitations on treatment and

continued reliance on the private health insurance industry.

The second lie is that Social Security, the single most important

economic “safety net” under the lives of America’s elderly, its

disabled, and children who lose a wage-earning parent, is headed for

“bankruptcy” and needs to have its already skimpy benefits cut back.

Let’s start with healthcare. The single biggest problem with health

care in America is that because it is run largely as a profit-making

venture, fully 20 percent of every healthcare dollar has to go towards

paperwork to take care of both the billing, and the monitoring of those

who do the billing, to make sure providers and insurers are not bilking

the system and/or the patients. Another significant percentage of each

healthcare dollar, despite all that paperwork, is wasted by fraud that

goes undetected—either in the form of unnecessary treatments and

medications, or simple billing fraud.

Just one example of this: Most hospitals, built with federal

assistance under the Hill-Burton funding program, are required to

provide a certain amount of free care to indigent patients who do not

qualify for Medicaid or Medicare, but who also have no assets. But as

anyone who has gone to a hospital emergency room without an insurance

card knows, when the bill comes for such treatment, it can easily top

$2000 for just a quick exam by a nurse practitioner and a dose of

aspirin. Why? Because the hospitals want these absurdly inflated

charges to count against their “uncompensated care” obligation. They

know that poor patients are never going to pay these bills, so they

later just shift them into their “free care” column. Insurers like Blue

Cross or state Medicare programs don’t reimburse them at anywhere near

those inflated rates, but that’s not the point.

In any event, where the big lie comes into play is in the

politicians’ refusal to consider simply making Medicare, the healthcare

program for the elderly, universal, which would effectively move the US

to a Canadian-style health system, with a few tweaks. Sure, making the

government the single insurer of all Americans would mean higher taxes,

but any honest accounting of this shift would have to consider how much

we ordinary middle-class and working-class Americans are paying now for

health care. For those who have employer-funded health plans, they are

typically paying anything from 20% to 100% of the premiums, or a

portion for themselves and 100% for other family members. These

payments can run into hundreds of dollars a month or even more. But

really, the sums being paid by the employer have to be added into the

cost too, because that is money that otherwise the employer could be

paying out in wages. For many working families, we could be talking

about as much as $10,000 a year or even more just for insurance

coverage. And of course, these plans don’t cover everything. There are

co-pays and deductibles that come out of the workers’ incomes, and that

can total several thousand dollars a year. The politicians neglect to

point out that by putting everyone on Medicare, all those costs are

eliminated.

Furthermore, by making the government the “single-payer” insurer,

the public’s bargaining power over private doctors and hospitals is

enormously enhanced, allowing us, as the government, to bargain for

lower rates for office visits, exams, and hospital stays and

procedures. Choice of physician is actually expanded, because no doctor

would be allowed to refuse to accept Medicare as payment in full, and

there would be no other option for doctors to receive payment.

There is a reason why the percentage of Gross Domestic Product

devoted to health care in the US is roughly 50% higher (and in some

cases two times higher) than in any of the countries with socialized

medicine, like Canada, Britain, France, Germany or Japan. There is also

a reason why the health statistics—life expectancy, infant mortality,

survival rates from various medical conditions, etc.—are higher in

those countries than in the US.--and are higher even in much poorer

countries that also have public health care systems. (There is also a

reason why socialized medical programs have survived in all those

countries even during periods when governments have been in the hands

of conservatives—the public would rebel if any effort were made to

eliminate them.)

As for Social Security, I always have to laugh when I hear

conservatives intone about the threat that Social Security will be

technically insolvent in 2041. These are, recall, the same people who a

year ago didn’t have a clue that the economy was about to go into a

death spiral. And we’re supposed to believe in their prognostications

about the state of a program whose fortunes are very closely linked to

economic growth models, not five years out or ten years out, but 32

years out. (The 2041 doomsday deadline is based upon a very

conservative estimate for annual average economic growth over the

intervening three decades.)

Just as an exercise, try to think back to 1977 for a minute. If you

are in your 20s or 30s, you are excused, since you cannot think back

that far. Let’s see: Jimmy Carter was president, oil was being

rationed, the Vietnam War had only just ended, songs like the Eagles’

“Hotel California,” Manfred Mann’s “Blinded by the Light,” Bob Seeger’s

“Night Moves” and the Sex Pistols’ “God Save the Queen” were topping

the charts, and the biggest existential threat to mankind was nuclear

war between the US and the USSR, which back then was still a country.

What will America and the world be like in another 32 years? You

can bet that it will be as far removed from anything you can imagine as

today is from what we were imagining back in 1977.

There are many things that should worry us a hell of a lot more

about that distant future a generation hence than the financial

condition of the Social Security Trust Fund. Just take the crisis of

global climate change. In 2041, scientists are pretty certain that

there will be no polar icecap in the summer. Now that is big—it has

never happened in the history of mankind on this planet, and we know it

is a change that will have profound impacts on climate all around the

globe, many of them terrifying. But are any of those people who are all

bent out of shape over the future of Social Security frantically

calling for action to deal with climate change? No. In fact, oddly, the

very people who get so worked up about the imagined crisis 30 years

from now in a government program are the ones most likely to be

unconcerned about climate change.

The big lie here is that Social Security is not some kind of

savings account, where you get back what you put in, with accumulated

interest. Social Security is a promise, by the government, and more

broadly—this being still a democracy of sorts—by the public, to provide

a basic income for retirees and the disabled. And the fulfillment of

that promise at any given time is going to depend upon the political

calculus of who wants to pay for that promise. I would argue that the

system is largely self-correcting. That is, when the demands on the

system are greatest, because of a larger number of retirees collecting

benefits relative to working adults who are paying taxes into the

system, those who are receiving assistance have a relatively greater

political clout, because of their increased numbers. The Baby Boom

population, which is the proximate cause of concerns about Social

Security funds “running out” will also be the most powerful senior

lobby in history when they (we, actually, as I am about to turn 60

myself!) are receiving Social Security benefits. With twice the voting

strength of the already powerful senior lobby today, Baby Boomer

retirees will be in a position to demand, and to get, decent retirement

benefits, even if that means higher taxes on current workers and

employers.

Nor does that imply a “generational war”—another boogeyman raised

by conservatives. The younger working generation, by and large, will be

the children and grandchildren of the Boomer retirees, and many if not

most of them will be enthusiastically supporting their older relatives’

demands for better benefits. Just ask yourself, when have you ever

heard a child complaining about the size of her or his parents’ Social

Security check? And yet even today, current benefits are at least

partially funded by current workers’ payroll deductions.

The point here is that progressives should resist any effort to

lend credence to conservative calls for cutbacks in Social Security and

Medicare. Any calls by Democrats, including President Barack Obama, for

“bi-partisan” commissions to study Medicare and Social Security are

simply cave-ins to ideologically motivated right-wing politicians and

their corporate backers, who want to destroy two of the most important

public-benefit programs run by the federal government. Democrats need

to mount a “Hands Off Social Security and Medicare!” campaign to put

themselves squarely in defense of these programs.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).