The compromise "is a positive step toward reducing the future path of the deficit and the debt levels," Steven Hess, senior credit officer at Moody's in New York, said in a telephone interview yesterday. "We do think more needs to be done to ensure a reduction in the debt to GDP ratio, for example, going forward." Bloomberg, Aug 2 (Image: Okko Pyykko)

How many times have you read or heard about the magic numbers concerning the ratio of national debt to gross domestic product (GDP)? This was trotted out by both sides of the debt ceiling debate as a fact: if the debt-to-GDP ratio exceeds 90%, the results will be dire. Therefore, our current situation calls for a crisis reaction and extreme measures to get below the magic number.

The problems with this analysis and the underlying research were never examined. This crisis worked so well at diverting public attention away from the real budget problems, we can assume there will be more debt ceiling crises in the future. It is worth understanding the problems with this ratio and the reasons to view conclusions and subsequent actions based on it as specious

Robert Shiller debunked this assumption in a short article written during the debate. He is a professor of economics at Yale and co-author of the respected Case-Shiller Housing Price Index.

Shiller makes some important points debunking the value of the ratio.

1. The ratio confuses cause and effect, the predictor and outcome variables. That's the type of error that gets your thesis proposal tossed out at your initial presentation. It's terribly humiliating, I'm told, and something graduate students in all disciplines go to great lengths to avoid. Here's what Shiller says;

"There is

also the issue of reverse causality. Debt-to-GDP ratios tend to

increase for countries that are in economic trouble. If this is part of

the reason that higher debt-to-GDP ratios correspond to lower economic

growth, there is less reason to think that countries should avoid a

higher ratio, as Keynesian theory implies that fiscal austerity would

undermine, rather than boost, economic performance." Robert Shiller, Delusions and Debt July 21

The debt problem is defined as the measurement of the problem -- a 90% or greater debt-to-GDP ratio. This is like manipulating a thermometer to show a lower body temperature and expecting that the lower measurement will alleviate the physical symptoms of a severe fever. It is backwards reasoning, to say the least.

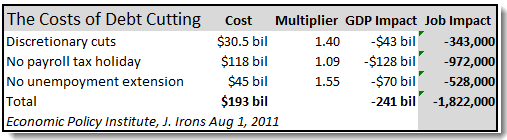

The outcome of this reverse causality, leading to austerity, is already projected. The final version of the bill just passed could cost up to 1.8 million jobs if only the following job killing cuts re put in place. From the Economic Policy Institute:

2. The Debt-to-GDP ratio is based on an arbitrary unit of time and, as such, makes no real sense. Shiller:

"Could it be that people think that a country becomes insolvent when its debt exceeds 100% of GDP?

"That

would clearly be nonsense. After all, debt (which is measured in

currency units) and GDP (which is measured in currency units per unit of

time) yields a ratio in units of pure time. There is nothing special

about using a year as that unit. A year is the time that it takes for

the earth to orbit the sun, which, except for seasonal industries like

agriculture, has no particular economic significance. Robert Shiller, Delusions and Debt July 21

Shiller points out that, in the case of Greece, if you "decadized" the debt over 40 years, the Debt-to-GDP ratio would be 15%, a figure the Greeks could be expected to pay. The conclusion that might be drawn from the analysis is that the crisis in Greece and the purported crisis in the United States are manufactured for the purposes of creating a crisis.

3. Shiller debunks the underlying analysis used to formulate the Debt-to-GDP ratio. The work announcing the 90% danger zone was by Reinhart and Rogoff, Growth in a Time of Debt, published at the end of 2009. This is supposedly the empirical basis for the 90% warning signal for dangers from Debt-to-GDP. Shiller points out:

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).