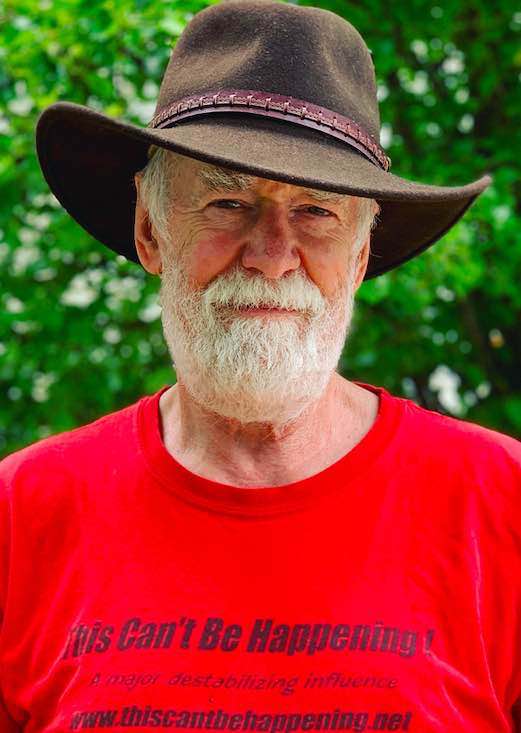

By Dave Lindorff

Hold everything!

Talk about déjà vu. Remember when Bush and his cabinet officers were running all over in late 2002 crying wolf about Iraq’s supposed nukes, and threatening that inaction on a war resolution by the Congress would leave them to blame when the “mushroom cloud” appeared over some American city?

Well, now they’re doing it again, this time claiming that economic Armageddon faces the US and even the global economy if Congress doesn’t hand over all power over the economy to the Secretary of the Treasury in absolute contravention of the most fundamental principle of the Constitution, which establishes that the budget be in the control of Congress. These guys are saying if Congress doesn’t vote to hand over $700 billion or more of taxpayer money to the Treasury to dole out to fat cat bankers, the resulting economic collapse will be on their heads.

But here’s the thing. Just as nobody else in the world was freaking out about Saddam Hussein’s alleged nuclear threat, nobody is particularly panicked about the US or the global economy. If investors, who are supposed to be all wise about things economic, were worried that the roof was about to cave in, they’d be selling stocks as fast as they could dial their brokers. And the institutional investors—those with the real inside information—not to mention the managements of companies, who really know the true state of affairs of their own firms—would be unloading shares at fire sale prices. The stock market would be falling like it fell in 1987, or, if what these administration con artists are claiming were really the case, even farther. That is to say, we’d be seeing a 3000-4000 point drop in the Dow.

But we’re not seeing that. The Dow Jones average this week fell a modest 8 percent and then recovered by 4 percent, and yesterday, the broader S&P index actually rose. Some panic!

We’re told that there is a credit crisis, but people are still getting mortgages. I know a retired woman of modest means who just went in and refinanced her mortgage at a lower rate. Businesses are still receiving loans, too, and while they might want a lower rate, they’re still meeting payroll. Banks haven’t jacked up interest rates to absurd levels.

Treasury Secretary Hank Paulson and Fed Chairman Ben Bernanke told a select group of Congressional leaders earlier this week that if they didn’t rush through their three-page proposal giving them draconian power to shovel public money into banker’s coffers, the country would be instantly plunged into a major recession.

But when Congress balked at this power-grabbing rip-off, it caused barely a ripple in the stock markets, which are down less than 10 percent from their level when the crisis first struck with the bailout of Fannie Mae and Freddie Mac.

Let’s be honest: this is an artificial panic, or worse, an effort to create one. It’s not a real panic. When you have the president and the treasury secretary and the Fed chairman going around warning of a steep recession or a depression, you have to ask yourself why these guys are yelling “Fire!” in the theater. In a real crisis, President Franklin Roosevelt preached calm (“We have nothing to fear but fear itself.”). This president says, “Be afraid. Real afraid!”

The truth is, this is a very normal economic downturn, with the exception that a lot of banks are holding an unusual amount of really rotten debt—the result of their own greed and fraud.

The answer is not to bail these rotten institutions out. It’s to let them fail.

I realized what was happening when the Bush Administration spent $85 billion assuming all the bad debt of AIG in return for warrants giving it the right to up to 80 percent ownership of the insurance giant, when, at that day’s share value, the Treasury could have bought the whole company outright for just $7 billion.

If we’re concerned about the homeowners who hold subprime mortgages, the government can step in and order the banks to renegotiate the terms of those loans to make them fixed 30-year mortgages that people can actually afford to pay, and it can step in and guarantee them. In return for covering the bankers’ asses on those loans, the government can take over the worst banks, and take ownership positions in others as it sees fit.

If the economy slows down because of all of this, the answer is for the government to start spending on programs that will create new jobs—R&D funding for new non-carbon energy sources, public funded power generation projects using wind, waves and solar energy, infrastructure repair, public transit expansion, more teachers for our schools. Every dollar spent on these kinds of things will circulate back into the economy immediately, helping to bring the economy back. Funneling money to banks won’t help, because the odds are, much of it will flow overseas where there’s a better return.

In short, Congress needs to call the president’s bluff.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).