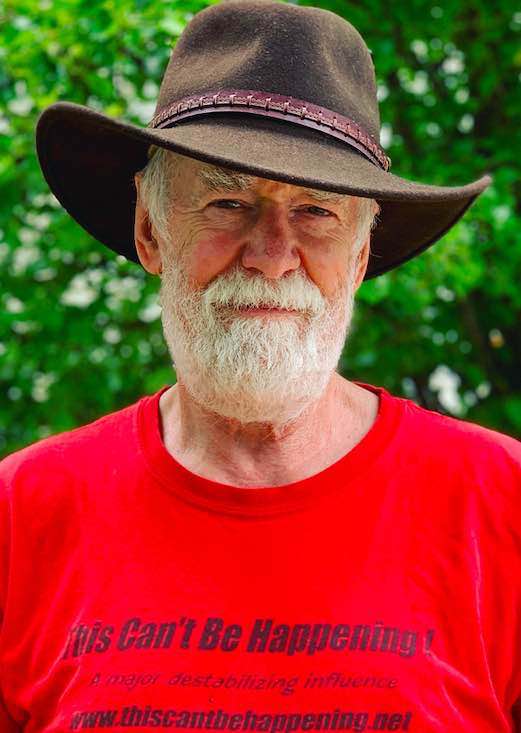

By Dave Lindorff

So now it turns out that the whole Troubled Assets Relief Program

(TARP) was a flop or more likely a scam. Remember Bush Treasury

Secretary Henry Paulson telling us last September that credit markets

had locked up, and then, after half of the $750 billion that he

extorted out of Congress was handed out to Wall Street firms, new

President Barack Obama justifying the spending of the second half of

the money because we needed to ├ éČ┼"get the banks lending again├ éČ Ł?

Well, now Neil Barofsky, the special inspector general for TARP, is

telling us that all that money, and another more than $2 trillion in

loans, accomplished nothing. In an interview

with Lagan Sebert, published in Huffington Post, Barofsky says, ├ éČ┼"We

were told by Treasury that the purpose of the TARP fund was to increase

lending. But we haven't increased lending.├ éČ Ł

Well yeah, that's true. Just ask any ordinary working stiff. My

little bank, the Harleysville National Bank here in eastern

Pennsylvania, far from expanding lending, has been shutting down

customer credit lines. As a bank manager told me, they were ├ éČ┼"reviewing

all our equity lines├ éČ Ł in light of declining property values (actually,

property values in our area north of Philadelphia have remained pretty

stable). In general, banks across the country have been canceling

credit lines, closing credit card accounts on customers deemed

risky├ éČ"including small businesses├ éČ"and making it very hard to get a new

mortgage. (They've also been raising all kinds of fees, ripping

customers off in other ways, but that's another story.)

And that goes for the biggest banks that got billions of dollars in taxpayer bailout funds.

Barofsky has been trying doggedly to find out whatever happened to

all that money of ours that was shoveled out to the banks, and as he

reports, he's been working not just without any help from the Treasury

Department, but actually against the active resistance of Treasury,

which he accuses of having tried to dissuade him from even looking into

it.

├ éČ┼"My biggest surprise,├ éČ Ł he says, ├ éČ┼"is when we announced an audit (of

TARP), Treasury went out of their way to say"it would be a big waste of

time.├ éČ Ł He says Treasury officials including Treasury Secretary Tim

Geithner, claimed that it would be impossible to find out where the

money went, on the argument that money is ├ éČ┼"fungible├ éČ Ł├ éČ"that is to say all

money is the same. Of course this is a cynical and ridiculous

assertion. If it were true, there would be no job for auditors, since

all auditors do is look to find out where money went. (Imagine telling

an IRS auditor that it is a waste of time auditing your books, because

money is fungible!)

In any event, Barofsky has gone about his work, with or without the

backing of the Obama Treasury Department, and what he found is that

instead of lending out the money that they were provided with by

taxpayers, the banks have been ├ éČ┼"acquiring other institutions, sitting

on it, paying down credit lines,├ éČ Ł and, of course, paying out obscene

bonuses to executives.

The one thing the banks are not doing is lending.

But then, as I wrote last February, it was silly to think that by

shoveling money into banks during a record recession, the banks would

then lend it out. First of all, there was the awkward reality that good

companies were and still are not looking to borrow money. Rather, they

are trying to pay down debt and get their balance sheets on more solid

ground to survive a period of low or declining sales and earnings. The

only companies that would be trying to borrow right now would be the

ones that were on the rocks, and wanted money just to stay afloat. And

what banker would lend to them? And second, if the banks could make

more money by investing their new cash instead of making risky loans

with it, why would they lend? So most of them just used the money to

invest in Treasury Bonds.

The long and the short of it is that we've been taken for a very

big and costly ride by banks that created a huge crisis and that then

got the government to bail them out of it with our money, and by two

administrations, one Republican and now one Democratic, that have been

submissive and willing servants of the big banks.

The big surprise to me has been Paul Volcker, who I mistakenly took

to be an over-the-hill relic and Wall Street patsy. The former Carter

and Reagan-era Federal Reserve Board chairman, currently chair of

President Obama's economic advisory panel, is publicly warning

that the president's bank policies are preserving a system of giant

banks that are ├ éČ┼"too big to fail,├ éČ Ł and are risking further, even larger

bailouts.

Barofsky agrees, saying that since the bailout, under Obama's bank

policies, big banks already deemed ├ éČ┼"too big to fail├ éČ Ł have become even

bigger, and he concludes, ├ éČ┼"We may be in a far more dangerous place

today than we were in a year ago,├ éČ Ł for having told certain financial

companies that we will not let them fail.

Little wonder that the smart money├ éČ"that would be the insiders in

corporate boardrooms and executive suites├ éČ"is reportedly selling shares

as fast as they can be sold, with the experts reporting

that insider sales of company stock are running 31:1 on the sell side.

The explanation: with layoffs still running at over 500,000 a month,

and nobody hiring, these executives don't see anything in the year

ahead or even longer that is likely to put the economy on a renewed

growth path.

Putting these bits of news together doesn't paint a pretty picture:

We've got an economy that appears headed for at best a long period of

stagnation and, more likely, for a second downturn, once the effect of

last March's stimulus package wears off. We've got a financial system

that has been propped up artificially, its balance sheets soggy with

underwater mortgages and worthless derivatives, and its executives

holding assurances that they can count on the government bailing them

out no matter what stupid or self-serving decisions they make. We've

got an economy that is 70% based upon consumer spending, in which one

in five people is unemployed or involuntarily underemployed. We've got

a nation that hardly makes anything, at the same time that its currency

is sinking like a stone, making imports increasingly expensive, And we

have a stock market that has been inflated into a giant bubble, just

waiting to pop.

October should be an interesting month this year.

_______________

DAVE LINDORFF is a Philadelphia-area journalist. His latest book is

├ éČ┼"The Case for Impeachment├ éČ Ł (St. Martin's Press, 2006). His work is

available at www.thiscantbehappening.net