By Dian L. Chu, Economic Forecasts & Opinions

Concerns over the global imbalance resulting from large Chinese current account surplus and large U.S. current account deficits has many economists and politicians locked in heated debates. Some experts, including Paul Krugman, propose measures focusing on changing China's exchange-rate policy and trade barriers.

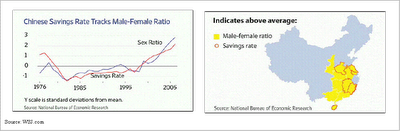

Indeed, the household savings rate in China went from about 16% of disposable income in 1990 to over 30% today. The comparable rate in the U.S. was about 3% before the crisis, and 6% in recent months.

The economic consequences are global as the excess savings directly impacts China's balance of trade and current account surplus. Many economists have asked the question - Why do the Chinese save so much?

While they all could be contributory factors; a recent paper by economists Shan-Jin Wei of Columbia University and Xiaobo Zhangk of the International Food Policy offers a different explanation - social policy.

The two economists suggest that sex selection in China has led to intense competition for brides. Savings rates have shot up as families strive to boost their sons' odds of marriage. (Click to enlarge graph)

Their study hypothesized that the strict 30-plus-year old one-child-per-family plan is the primary driver of the high savings rate. This, coupled with a cultural preference for male offspring, has led to a significant imbalance between the number of male and female children born to its citizens.

Statistically speaking, this translates into about one in five Chinese men out of the marriage market when the current generation of children grows up. The resulting pressure might incentivize men and parents with sons to increase savings in order to have a competitive edge in the marriage market.

The paper estimates that about half of the increase in the savings rate over the last 25 years can be attributed to the rise in the sex ratio imbalance. The authors further argue that:

"None of the discussions [on global imbalance] have brought family planning policies or women's rights to the table .... Our research, however, suggests that this is a serious omission."

The authors also point out that even those not competing in the marriage market must compete to buy housing and make other significant purchases, pushing up the savings rate for all households.

This conclusion actually brings up part of the point I've raised in previous articles. That is, China needs time to push through difficult economic and social reforms to increase investment and consumption, while reducing savings rate at home, before it can allow its currency to float freely against the dollar.

These reforms could take up to 10 years to implement. And only when the productivity of China reaches that of the United States will the two countries' price structures converge.

Resolving these global imbalances requires all major surplus and deficit countries to work through a complex adjustment process. One can only implement a proper policy through rational discussion over an understanding of the diagnosis.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).