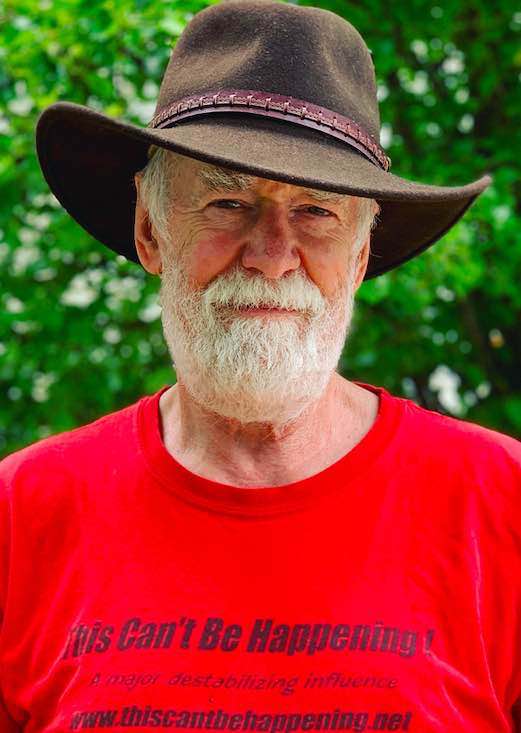

By Dave Lindorff

The most entertaining thing about this Wall Street crisis and the

refusal of the House of Representatives (not failure but refusal) to

pass a bailout bill negotiated by the Bush White House and the House

leadership is how shocked and upset those leaders and the pundit class

have been by the idea that members of Congress would actually heed the

wishes of their constituents!

The Founding Fathers always saw the lower house of Congress as

voice of the people—the elected body that, because its members had to

face the voters every two years, would be most responsive to public

sentiment.

Because of the power of money and the role of the corporate media

in filtering the information that voters get about what is actually

going on, that close connection between public and public servant in

the House has long ago broken down. This time, however, because the

crisis hit within five weeks of the national election, and because the

crisis involved something that everyone cares about—their money—it

worked.

The public is paying attention, and most of us got it. It was

obvious that Congress and the White House were out to screw us out of

our money in order to protect the millionaire and billionaire traders

and conmen who have been running the Wall Street casino for the last

decade and a half without any adult supervision.

Now that people are paying attention, it will be interesting to see

how these corrupt leaders, Democrat and Republican, will fashion that

bailout and get it passed. Once aroused from their TV-induced slumber,

the American public may not be willing to get rolled. If the anger

grows, and the calls and emails to Congress—which brought down the

Capitol website Monday and jammed the switchboard for several days

beginning last week—continue to flood in threatening an electoral

Armageddon for those who back a bailout, Congress may yet be unable to

pass a bill.

It doesn’t get any better than this.

Now let’s make something clear. The stock market crash that

happened on Monday was no crisis. The market can rise and fall with

little or no significant impact on the broader economy, or even on

those who have their retirement income invested in equities. While

Treasury Secretary Hank Paulson, Fed Chairman Ben Bernanke and House

leaders like Speaker Nancy Pelosi or Minority Leader John Boehner may

point frantically to the falling Dow as a dire warning to members of

Congress to take action, it is all just scaremongering.

The real issue is not the stock market—it’s the credit markets. And

these have been shut down to borrowers—both individuals and

corporates—for months. Which means that there is no sudden urgency to

pass a lousy, rip-off bailout bill in days without proper hearings and

investigations into what is really needed.

The Bush Administration’s whole idea here from the start was to use

scare-mongering and high-pressure tactics honed in the 2002 campaign to

gin up a war against Iraq to get a bill through Congress that would

make a virtual dictator out of the Treasury Secretary, and to siphon a

trillion dollars or more out of taxpayers’ accounts and into the

pockets of the already stunningly rich financial class. It was to be

one final wrecking ball by the Bush/Cheney gang launched at the

American economic and political system, allowing the people who have

run the country into the ground over the last eight years, and their

financial backers to walk away with all the cookies.

It could still happen if the public doesn’t stay fired up and

angry. But for now, it’s at least exciting and deeply satisfying to see

the Administration, and the cowards who run the so-called Democratic

opposition in Congress, scrambling frantically to come up with a scheme

to get this ripoff passed.

What should happen? Congressional Democrats should put a hold on any action until after Election Day, which after all is only five weeks off. They should say that the voters must be heard on this critical national issue of how to rescue the economy and fix the financial system. Hearings should be scheduled in the relevant committees—oversight, banking, securities regulation, housing, the elderly, health and human services, etc. (yes, Rep. Dennis Kucinich is right in observing that given that most bankruptcies in the US are caused by medical emergencies, if the US had national healthcare, we wouldn’t have the housing foreclosure crisis)—and a special prosecutor should be established to look into the corruption behind all the recent financial sector failures. The real victims of the deregulatory orgy need to be heard, as do some of the 200 economists (including at least three nobel laureates) who have opposed this bailout. Then when the true nature and extent of the crisis and its causes have been laid out in clear public view, along with some real solutions for real people, appropriate legislative reforms should be drawn up, debated and voted upon, to be finally enacted into law.

No rush to judgment! No short-circuiting of the critical process of hearings!

The economy will survive this process.

What we cannot survive is a continuation of secret government, backroom deals and trillion-dollar bailouts.

BACK TO THE PHONES!

_______________________

DAVE LINDORFF is a Philadelphia-based journalist and columnist. His

latest book is “The Case for Impeachment” (St. Martin’s Press, 2006 and

now available in paperback edition). His work is available at www.thiscantbehappening.net