Secret White House letter to G-20

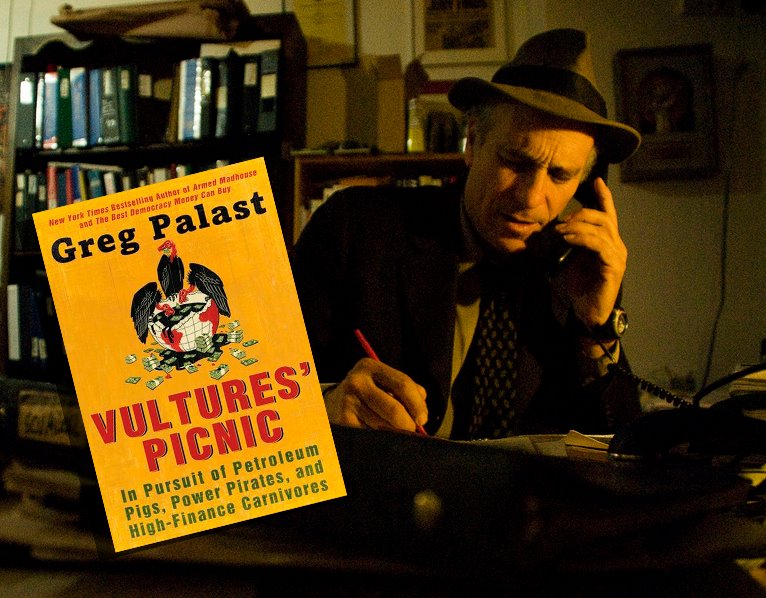

by Greg Palast

Tuesday, September 22, 2009, New York

For The Huffington Post

I still get a thrill whenever I get my hands on a confidential memo with "The White House, Washington" appearing on the letterhead. Even when� ��"like the one I'm looking at now� ��"it's about a snoozy topic: This week's G-20 summit.

The 6-page letter from the White House, dated September 3, was sent to the 20 heads of state that will meet this Thursday in Pittsburgh. After some initial diplo-blather, our President's "sherpa" for the summit, Michael Froman, does a little victory dance, announcing that the recession has been defeated. "Global equity markets have risen 35 percent since the end of March," writes Froman. In other words, the stock market is up and all's well.

While acknowledging that this year's economy has gone to hell in a handbag, Obama's aide and ambassador to the G-20 seems to be parroting the irrational exuberance of Federal Reserve Chief Ben Bernanke who declared last week that, "The recession is very likely over." All that was missing from Bernanke's statement was a banner, "MISSION ACCOMPLISHED."

And the French are furious. The White House letter to the G-20 leaders was a response to a confidential diplomatic missive from the chief of the European Union Fredrik Reinfeldt written a day earlier to "Monsieur le Prà �sident" Obama.

We have Reinfeldt's confidential note as well. In it, the EU president says, despite Bernanke's happy-talk, "la crise n'est pas terminà �e (the crisis is not over) and (continuing in translation) the labor market will continue to suffer the consequences of weak use of capacity and production in the coming months." This is diplomatic speak for, What the hell is Bernanke smoking?

May I remind you Monsieur le Prà �sident, that last month 216,000 Americans lost their jobs, bringing the total lost since your inauguration to about seven million. And rising.

The Wall Street Journal also has a copy of the White House letter, though they haven't released it. (I have: read it here , with the EU message and our translation.) The Journal spins the leak as the White House would want it: "Big Changes to Global Economic Policy" to produce "lasting growth." Obama takes charge! What's missing in the Journal report is that Obama's plan subtly but significantly throttles back European demands to tighten finance industry regulation and, most important, deflects the EU's concern about fighting unemployment.

Europe's leaders are scared witless that the Obama Administration will prematurely turn off the fiscal and monetary stimulus. Europe demands that the US continue pumping the economy under an internationally coordinated worldwide save-our-butts program. As the EU's Reinfeldt puts it in his plea to the White House, "It is essential that the Heads of State and Government, at this summit, continue to implement the economic policy measures they have adopted," and not act unilaterally. "Exit strategies [must] be implemented in a coordinated manner." Translating from the diplomatique: If you in the USA turn off fiscal and monetary stimulus now, on your own, Europe and the planet sinks, America with it.

Obama's ambassador says, Non! Instead, he writes that each nation should be allowed to "unwind" anti-recession efforts "at a pace appropriate to the circumstances of each economy." In other words, "Europe, you're on your own!" So much for Obama channeling FDR.

The technical policy conflict between the Obama and EU plans reflects a deep difference in the answer to a crucial question: Whose recession is it, anyway? To Obama and Bernanke, this is a bankers' recession and so, as "stresses in financial markets have abated significantly," to use the words of the White House epistle, then Happy Days Are Here Again. But, if this recession is about workers the world over losing their jobs and life savings, the EU view, then it's still Buddy, Can You Spare a Dime.

If Bernanke and Obama were truly concerned about preserving jobs, they would have required banks loaded with taxpayer bail-out loot to lend these funds to consumers and business. China did so, ordering its banks to increase credit. And boy, did they, expanding credit by an eye-popping 30%, rocketing China's economy out of recession and into double-digit growth.

But the Obama Administration has gone the opposite way. The White House letter to the G-20 calls for slowly increasing bank reserves, and that can only cause a tight credit market to tighten further.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).