| Back OpEd News | |||||||

|

Original Content at https://www.opednews.com/articles/The-Legends-of-Quantitativ-by-Shalom-Patrick-Ham-100930-32.html (Note: You can view every article as one long page if you sign up as an Advocate Member, or higher). |

|||||||

October 1, 2010

The Legends of Quantitative Easing

By Shalom Patrick Hamou

Numerous people are worried by Quantitative Easing but obviously most don't understand exactly what it really means and what are the risks. Those risks are more formidable than commonly thought

::::::::

Numerous people are worried by Quantitative Easing but obviously most, even some of the best economists, don't understand exactly what it really means and what are the risks. Those risks are more formidable than commonly thoughtHow Did we Get There?

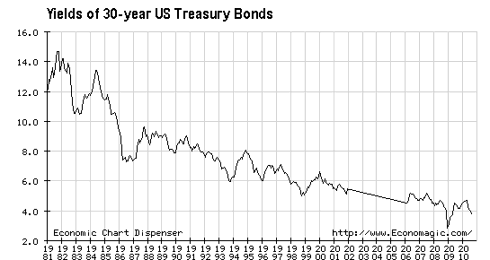

The reason of the present crisis is the secular downward trend of the marginal return on investments as depicted by the chart of the 30 years US Treasury Bonds and the chart of the Yields of 10 Years US Treasury Notes.

When those return on investments were so low as to be below the fair price for interest rate risk banks have started to slow lending and/or made unprofitable investments.

The basic reason for those lower and lower rates of returns was not the absence of credit but a decrease of demand. As long as short-term yields were above zero the Fed could adjust supply and demand by lowering short-term rates. That of course ended when the short-term yields, the target discount rate became at or very close to 0%.

Here comes Quantitative Easing.

Purpose:

The intended purpose of Quantitative Easing is to bring down long-term yields, by lowering the yields of long-term treasuries in order to generate marginal investments.

The first thing we remark is that the crisis we are witnessing today is generated by excess investments in front of a deficit in demand. So bringing down the rates for the borrower is a very intricate scheme. The idea being to generate a sufficient flow of investments which hopefully will trickle down into sufficient demand. that in itself is convoluted. The very fact that demand decreased was due to the fact that not enough of investments trickled down to wages and consumption. Amplifying the phenomenon by tweaking the credit market is intuitively doomed to fail.

Why would you generate more of something you have already too much of? If you are fed up will more food make you more hungry?

In effect tweaking the yield curve has already been done, In Japan during the lost decade (which is 18 years old now) but also by the Fed in the 60's in what was called Operation TWIST. It resulted in a formidable and costly failure which caused the abandon of the Gold Standard.

Chairman Alan Greenspan had a more realistic view of the power of that tool:

Can the right monetary and fiscal policy keep the US out of a recession?

Probably not. Global forces can now override most anything that monetary and fiscal policy can do. Long-term real interest rates have significantly more impact on the core of economic activity than the individual actions of nations. Central banks have increasingly lost their capacity to influence the longer end of the market. Two to three decades, ago central banks were dominant throughout the maturity schedule. Thus, the more important question is the direction of long-term real interest rates.

The second assumption of Quantitative Easing is that by lowering long-term yields on Treasuries you are going to lower the yields on Corporate Loans and provide more capital to these corporations.

As I explained Quantitative Easing is bringing the Treasuries yield curve below what would be its fair value with the hope of providing businesses with funds that are below 0% once discounted for interest rate risk. For example the fair rate for 10 years Treasuries would be 3.50% and the fair yield of 30 years treasuries would be around 4.60%. With the present yields on long term treasuries it is akin to set, secretly and unobserved the risk free rate at -1% thus subsidizing the borrowers with the Fed's money.

The idea is to jump start the economy and hopefully get it back to a normal regime. That can not be done:

The first question is what are the yields that would be supply to the pre-crisis economic development? And secondly and more importantly how can you reverse what is called the Greenspan Conundrum or Bernanke Saving's Glut and return to an adequate long-term yield in order to be able to let the market adjust itself?. Our research tells us that it was due to the growth of income/wealth disparity and this economy does not know how to reverse that secular trend. Worse the recession has increased the speed of growth of that income/wealth disparity.

So the long-term yield that would be needed to return to the pre-crisis level of economic growth and devloppment can be very low.

The ideal interest rate for the US economy in current conditions would be minus 5 per cent, according to internal analysis prepared for the Federal Reserve's last policy meeting.

The analysis was based on a so-called Taylor-rule approach that estimates an appropriate interest rate based on unemployment and inflation.

A central bank cannot cut interest rates below zero. However, the staff research suggests the Fed should maintain unconventional policies that provide stimulus roughly equivalent to an interest rate of minus 5 per cent.

That would mean that, according to the Fed the ideal rate on the 30 Years US Treasury Bond would be... -0.40%!!!! which is impossible to reach given the zero lower limits on interest rates!

There is no theoretical limit above 0% to which the Federal Reserve could bring those yields: the Fed has no theoretical limits to the size of its balance sheet. Remember it is the Fed so it is emitting the money and it can emit as much as it pleases.

The problem is that if it can bring down the Treasuries yield curve the action on private loans and investments is less direct. For the present moment it works relatively well for corporations which can emit bonds, even those with a junk rating, But that action is obviously inefficient for the small businesses for which the marginal return on investment is going down and the default risk premium is shooting up.

Efficiency of Doctor Bernanke Fantasy Math So Far:

The only measure of the efficiency of the monetary policy, according to the monetarists, is the M3 component of the money supply. The Fed conveniently decided in March 2006 as they knew that the Liquidity Trap was the inevitable to stop publishing that critical piece of data. However several think tank do compute it following their own formula. One of them is John Williams Shadow Government Statistics.

According to monetarist theory it means that the economy is still in a deep recession and that governments statistics that tend to exhibit a mild growth are lies. It is well known that promises engage only the one that receives it.

Although the NBER who tells several month after the fact when the US enter or exit a recession said that this one ended in June 2009!! His Chairman In a Bloomberg video, Harvard University Professor Martin Feldstein, who sits on the Business Cycle Dating Committee of the National Bureau of Economic Research says, as an oratory precaution at the Jackson Hole retreat that "there is not much the Fed can do"

(") "I would say there's still a significant risk, maybe one chance in three, that there will be a double dip, real GDP falling, before we're in the clear," said Feldstein, member of the committee at the National Bureau of Economic Research that dates the beginning and end of recessions. (")

"We see a weak economy," Feldstein said. "We see a fragile economy that is growing at a slower pace."

(") The 1.6 percent growth rate is still "very weak" and another slump would signal that the nation remains mired in a recession, Feldstein, 70, said in a separate interview with Bloomberg Television from Jackson Hole, Wyoming, where the Federal Reserve is holding its annual symposium.

"If the economy turns down again, we would still be in recession, but that remains to be seen," said the New York-born economist, who twice served as president of the NBER from 1977 to 1982 and from 1984 to 2008.

(")Feldstein's remarks contrast with those of Federal Reserve Chairman Ben S. Bernanke, who told conference attendees that "the preconditions for a pickup in growth in 2011 appear to remain in place." (")

The Fantasy of Hyperinflation:

I am proposing here a non competitive agreement to Doctor Ron Paul: I agree to never try to cure a patient if he agrees to never deal with monetary policy. This way we will save the life of both patients and the economy. That would be in itself quite an achievement.

For the Future we Have Then Two Types of Possible Scenari:

The strongest business will take over the smallest businesses or their market share and we will have an increasingly high concentration of capital. It will be the death of the small enterprise. But that is the best scenario.

The second is that the economic activity of the strongest businesses won't be enough to replace the economic activity of the small enterprise (my working hypothesis) and that more and more businesses will not be able to get funded because their marginal return on investments will go down and their default risk premium will go up. That disruption of capital markets can be brutal.

Even with sound credit-risk management, a sudden widening of credit spreads could result in unanticipated losses to investors in some of the newer, more complex structured credit products, and those investors could include some leveraged hedge funds. Risk management involves judgment as well as science, and the science is based on the past behavior of markets, which is not an infallible guide to the future.

In anyway without a prior increase of demand it is difficult for us to imagine that the increase of investment will be sufficient to trigger a magical recovery. The answer could be that the Fed would buy corporate debts, then we can ask ourselves what is the limit? The Fed could end up owning all the debt of every corporation in the USA. PIMCO has already suggested that the mortgage market should be nationalized! That would mean that the credit market would be nationalized or at least its risk, which would mean that it is the Fed that would decide which corporation deserves to get credit and will live and which one does not and will die (Lehman Brothers vs Citi Group).

How Long Can Doctor Bernanke Run the Show?

The Limits of Doctor Bernanke; I have since 1994 predicted the inevitable collapse of the capital market what I have not predicted was the size, the brutality and injustice of the non conventional measures of Doctor Bernanke.

In fact we are already as most of market participants have noticed in a new phase of non conventional monetary policy: not only does the Fed buy long dated Treasuries it buys also all sort of different investment vehicles:

The Deflation Bias and Committing to Being Irresponsible by Gauti B. Eggertsson of the Federal reserve Bank of New York:

Abstract: I model deflation, at zero nominal interest rate, in a microfounded general equilibrium model. I show that one can analyze deflation as a credibility problem if three conditions are satisfied. First: The government's only policy instrument is increasing the money supply by open market operations in short-term bonds. Second: The economy is subject to large negative demand shocks. Third: The government cannot commit to future policy. I call the credibility problem that arises under these conditions the deflation bias. I propose several policies to solve it. They all involve printing money or issuing nominal debt. In addition they require cutting taxes, buying real assets such as stocks, or purchasing foreign exchange. The government "credibly commits to being irresponsible" by pursuing these policies. It commits to higher money supply in the future so that the private sector expects inflation instead of deflation. This is optimal since it curbs deflation and increases output by lowering the real rate of return.

What it means is that the Fed is slowly, secretly and unobserved buying all the investments vehicles in the US economy that is, if I am right, called in other countries rampant socialism. It means that it is the Fed that will ultimately bear the investment risk and hence decide what business will deserve to live and receive credit and which will deserve to die and will not receive credit. Marx and Lenin didn't do anything more and nothing less. The only notable exception is that it is the owners of the Corporations that will ultimately receive the dividends while the Fed will bear both the systematic and specific risk! The privatization of the profit and the socialization of the risk!

Of course that nationalization of the capital market is not the intention of Doctor Bernanke he is optimist and believes he will, once the illness is cured, unload his balance sheet. But how much of his $2 trillion balance sheet has he unloaded since he started his Quantitative Easing adventure: Zilch!. What is the size of his off balance sheet obligations: the amount of loans he has already explicitly guaranteed? The definition of insanity is doing the same thingover and over again and expecting different results. An optimist is a misinformed pessimist.

One of the expected advantage of buying stocks is to create, it is hoped, optimism in the future state of the economy.

In one of the greatest investment markets in the world, namely, New York, the influence of speculation (in the above sense) is enormous. Even outside the field of finance, Americans are apt to be unduly interested in discovering what average opinion believes average opinion to be; and this national weakness finds its nemesis in the stock market.

Fed Engineered Asset Price Bubble:

That is ill founded. Optimism in the economy is meant to make people who have money spend and invest. But you can spend and invest what is in your pocket. It is rare, I am told, that optimism will entice you to spend the money you don't have except in the case of the Irrational Exuberance of the bipolar in manic stage, which are statistically not numerous enough to jump start an economy.

The market will soon find out that there is no risk in buying stocks of established companies (mainly the companies included in the SP500) That will create a moral risk and some sort of irrational exuberance. With interest rate at 0% the present value of those stocks could reach stratospheric values in a very short period of time.

We know that Asset Price Bubbles are not Without Dangers:

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy? We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs, and price stability. Indeed, the sharp stock market break of 1987 had few negative consequences for the economy. But we should not underestimate or become complacent about the complexity of the interactions of asset markets and the economy. Thus, evaluating shifts in balance sheets generally, and in asset prices particularly, must be an integral part of the development of monetary policy.

Thus, this vast increase in the market value of asset claims is in part the indirect result of investors accepting lower compensation for risk. Such an increase in market value is too often viewed by market participants as structural and permanent. To some extent, those higher values may be reflecting the increased flexibility and resilience of our economy. But what they perceive as newly abundant liquidity can readily disappear. Any onset of increased investor caution elevates risk premiums and, as a consequence, lowers asset values and promotes the liquidation of the debt that supported higher asset prices. This is the reason that history has not dealt kindly with the aftermath of protracted periods of low risk premiums.

Our day-by-day experiences with the effectiveness of flexible markets as they adjust to, and correct, imbalances can readily lead us to the mistaken conclusion that once markets are purged of rigidities, macroeconomic disturbances will become a historical relic. However, the penchant of humans for quirky, often irrational behavior gets in the way of this conclusion. A discontinuity in valuation judgments, often the cause or consequence of the building and bursting of a bubble, can occasionally destabilize even the most liquid and flexible of markets. I do not have much to add on this issue except to reiterate our need to better understand it.

I made a mistake in presuming that the self-interests of organisations, specifically banks and others, were such that they were best capable of protecting their own shareholders and their equity in the firms,

Those of us who have looked to the self-interest of lending institutions to protect shareholders' equity (myself especially) are in a state of shocked disbelief.

Waxman: Do you feel that your ideology pushed you to make decisions that you wished you had not made?

Greenspan: Well, remember what an ideology is: it is a conceptual framework about the way people deal with reality; everyone has one; you have to; to exist you need an ideology. The question is, whether it is accurate or not. What I'm saying to you is, yes, I found a flaw. I don't know how significant or permanent it is. But I have been very distressed by that fact.

Waxman: You found a flaw in the reality? (!!!??)

Greenspan: I found a flaw in the model that I perceived as the critical functioning structure that defines how the world works.

Waxman: In other words, you found that your view of the world, your ideology, was not right, was not working.

Greenspan: Precisely. That's precisely the reason I was shocked because I had been going for 40 years or more [on this model] with very considerable evidence that it was working exceptionally well

Conclusion:

I pronounce officialy the death of the free market capitalist economy if not of the capitalist economy.

We

have no hope that those eggheads at the Fed and at the

Treasury will ever change their Ideology and lead a policy contrary to

the special interest groups and vested interests they defend and

understand that credit is the least critical systemic linkage of the

economy. The most critical systemic disruption comes from the lack of

consumption capacity of the ordinary folks. We know they will continue

to deseperatly pump the liquidity pipe in order to try to revive

investments when it is the last thing this economy needs: it is

precisely why it is called a Liquidity Trap.

This is why we offer the possibility for anyone to create in parallel

to this prevalent economy, incremental jobs, consumption and later and

less urgently investments:

Innovative

Credit Free, Free Market, Economic Ideology

A Tract on Monetary Reform

Authors Website: blog.cantona.me

Authors Bio:

I have an engineer diploma from Ecole Centrale de Lyon (France) and a MBA from Boston University. Since 1986 till 1994 I have worked as a broker dealer on the French Domestic Fixed interest market.

Since the spring of 1994 I have worked on the fact that the secular downward trend in long-term yield would, at some point, bring a market crash.

I have resolved the famous Greenspan Conundrum as I discovered that long-term yields decrease with the increase of income/wealth gap. Hence income distribution is an important factor of macro economic development.

I have developed a model of the yield curve that describe long-term yields as options on shorter term yields.

My conclusion was that when a "inverted' yield curve, as it would necessary be, would return to its fair value it will trigger a market crash which under the circumstances of a 0% short-term interest would be of major consequences.