Finally, it should be added that because of massive unemployment, which is approaching levels not seen since the Great Depression, and because of the massive loss of personal wealth, this recession is not likely to act like any of the other recessions of the post-World War II era. These have all been � ??U� ? � or � ??V� ? �-shaped affairs, where economic activity would either drop and then after lingering at a low level for a while, recover at an accelerating rate, slowly recover as in a � ??U� ? �, or plunge precipitously to a sharp bottom and then quickly recover, as in a � ??V� ? �. This time, we are more likely to see an � ??L� ? �-shaped recession, where the economy hits bottom at some point, and then operates for years at a much lower level. That lower part of that � ??L� ? � might rise slowly, but it wouldn� ??t rise by much. In this case, we would see continued high levels of unemployment, lower wages, and no bounce-back in personal wealth.

So if we� ??re want to make the correct policy decisions, not to mention the right political decisions and personal financial and basic life decisions, let� ??s cut the happy talk, and start keeping it real.

__________________

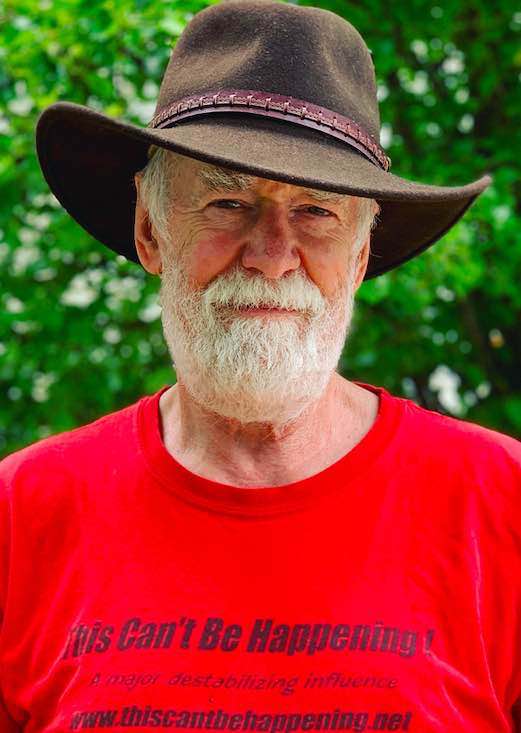

DAVE LINDORFF is a Philadelphia-area journalist. His latest book is � ??The Case for Impeachment� ? � (St. Martin� ??s Press, 2006). His work is available at www.thiscantbehappening.net

Â

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).