See interactive map at International Nuclear Safety Center

Japanese Energy and Economic Disruption

Eighty percent of Japanese energy relies on imports. Nuclear plants provide about 30% of the electric production for the industrial base. The loss of the Fukushima I plant, for example reduces the nuclear output by 10%, just for starters. It also derails the big plans Japan has for nuclear power through 2050. Over 60% of domestic needs will be met by a robust nuclear program according to one optimistic estimate.

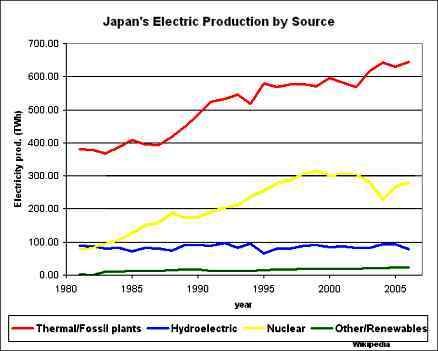

The following graph shows the contributions electrical production:

See interactive map at International Nuclear Safety Center

Japanese Energy and Economic Disruption

Eighty percent of Japanese energy relies on imports. Nuclear plants provide about 30% of the electric production for the industrial base. The loss of the Fukushima I plant, for example reduces the nuclear output by 10%, just for starters. It also derails the big plans Japan has for nuclear power through 2050. Over 60% of domestic needs will be met by a robust nuclear program according to one optimistic estimate.

The following graph shows the contributions electrical production:

Assume a 20% loss of nuclear power production with the elimination of Fukushima's 10% contribution and other reactors that may go offline due to preemptive safety precautions. Japan faces a near term energy shortage. The loss of 20% of nuclear production, for example, could translate into a 6% percent reduction of overall electric production. Hydroelectric and renewables are not capable of rising to the occasion as replacements. That leaves thermal/fossil plants. More imports and more pollution will go hand in hand for the next few years. Japan will pay much more attention to the Middle East, the source of 90% crude oil imports, with less focus on planned spread of nuclear plants.

This is speculation. The situation may be much worse. One thing is certain. The government regulator's confidence that "we will resolve this" seems far-fetched at best.

The damage to plant, equipment, and infrastructure led to the shut down of several automobile plants. United States exporters will feel the impact of lower Japanese corporate revenues. China, Japan's top trading partner, may well see the loss of investment and export opportunities. In addition, China may have a new competitor for crude oil due to the disruption to Japan's overall energy supply system.

Still mired in the great stagnation since 1985, healthcare costs, rebuilding requirements, and the implosion of energy production in the Fukushima Prefecture will hit the domestic economy very hard in short order.

Next Page 1 | 2 | 3 | 4 | 5 | 6

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).