Speculation reigns supreme in your nation's capital. Who is next in line after the bin Laden operation? The bipartisan coalition directing the war on terror forgot one important fact about the security of the United States of America. It doesn't matter who they kill overseas, the assault on almost all citizens continues unabated at home. No one is doing anything to stop it. Only the financial and political elite remain immune. (Image-WikiCommons)

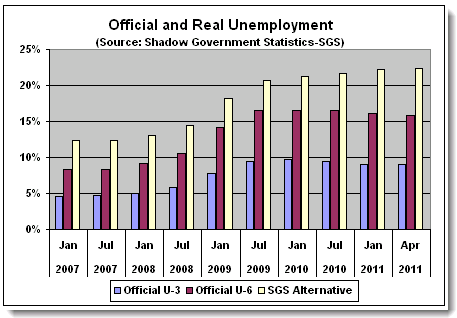

According to the National Bureau of Economic Research, the national economic collapse (aka recession) ended June 2009. That's news to the 55% of the public that believe we're in either a recession or depression (April 2011).

Official unemployment is around 9%. That excludes the marginally employed and under employed. Adding those two groups takes unemployment up to 15.9%. Add the long-term unemployed and the figure climbs to nearly 23%.

The total of all types of unemployment and underemployment approached Great Depression levels in 2009. (Link)

When you have 23% real unemployment/underemployment among those willing and able to work, you have budget deficits at every level of government. Businesses fail or slow down. Governments reduce or eliminate services. People lose their homes and health insurance. Credit ratings dive, making it more expensive or impossible to borrow for any reason, including emergencies. The unemployed contribute much less to the economy, which shrinks substantially, leading to more under or unemployment. There future darkens. All that's left is hope, a commodity of little use today.

If you're part of the financial elite in crowd, you don't need hope. You're about to get another big payday. Much lower taxes and relaxed regulation of foreign exchange derivatives are on the way.

More Corporate Welfare -- Tax Breaks for Those with all the Breaks

Obama administration Treasury Secretary Timothy Geithner plans an overhaul of the corporate tax rate. His boss, the president approves, no doubt. Politico reports that Geithner's proposal will reduce corporate income tax from the current 35% to between 26% and 28%. This is a charade since few major corporations pay anywhere near the proposed 26%. ATT paid federal income tax of 2.7% last year. General Electric, with pretax profits of $10.3 billion, paid nothing and got a $1.1 billion tax benefit.

The administration's proposed corporate tax breaks are window dressing to obscure corporate tax breaks that reduce what corporations actually pay, around 17% a year according to one study. There will be no provision to rectify the difference between tax rates on domestic corporate income, 35%, and the 15% corporate tax for income gained overseas.

Will we see loopholes closed that keep most corporations from even coming close to paying the full amount of income tax?

Count on hearing that US corporate tax rates are the highest in the world. This is simply untrue when you count the taxes actually collected. According to the Organisation for Economic Co-operation and Development (OECD), US corporate taxes accounted for 2.1% of the US gross domestic product (GDP-see graph) in 2009, highly favorable compared to the rest of the industrialized world.

To offset any lost tax revenues, Geithner's plan will end some key tax benefits for US manufacturing companies. We can assume that these manufacturing companies will cover the tax benefits for multinationals until the last manufacturing job leaves the United States.

In what appears to be high comedy, Politico reported that,

"Aides say Geithner will personally dive into the negotiations. House Speaker John Boehner also sees this as a ripe area for bipartisan cooperation."

This defies belief. Negotiations require differences. When it comes to corporate policy and subsidies, there is just one party position; that of the bipartisan coalition called The Money Party.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).