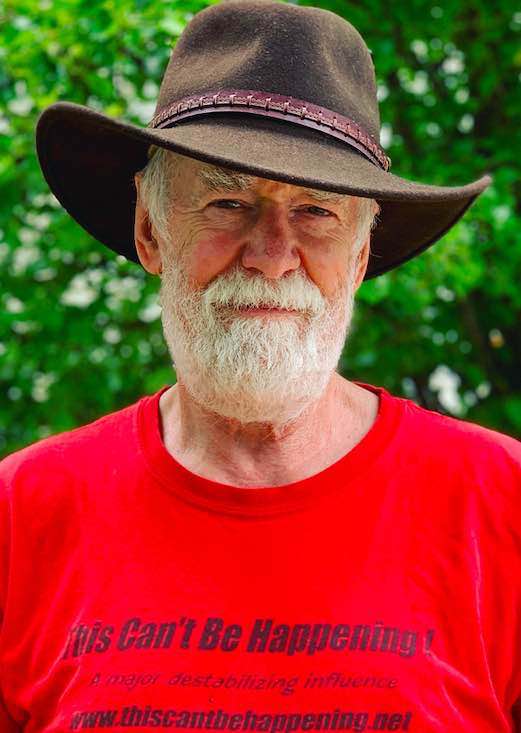

By Dave Lindorff

Free market aficionados, particularly in the media, have long been

wont to tell us that the "market knows best." That was always the line

when progressives (remember when there used to be progressives in

government?) would come up with some do-good scheme like a public jobs

program during the Johnson War on Poverty, or Medicare, or bigger

subsidies for urban mass transit. If the stock market sank, they'd

pronounce whatever program or bill it was as a bad idea, because "the

market" (meaning investors), had nixed it by selling shares.

The same kind of analytical brilliance has been routinely ascribed

by economic pundits to investors when it comes to business

decisions--particularly mergers and acquisitions, or divestments and

breakups. If Bank of America announces that it is going to buy the

foundering Merrill Lynch and shares of B of A fall, then the merger is

a bad idea. If the shares rise, it's a good idea. And so it goes.

The whole idea that a bunch of people who sit around at computer

screens betting on stocks and eating cheese doodles all day really know

much of anything, or that taking their herd responses collectively as

some kind of delphic oracle has always seemed the height of folly to

me. But if you really wanted proof that investors taken collectively

are idiots, you could simply look at today's stock market. Yesterday,

every index plunged by about 4%, pulling the overall market to lows not

seen in 12 years, because of concerns that the recession was deepening,

that the big banks were toast, and that the government's economic

stimulus plan was not going to help much.

There was every reason to expect the downward trend to continue,

but up stepped Federal Reserve Chair Ben Bernanke, and, in a statement

presented in Congress, said that in his considered view, the current

recession could be over by the end of this year.

Relieved investors jumped back into the market and bought stocks,

pushing the Dow and the S&P indexes back up by almost as much as

they'd lost the day before.

But wait a minute! Isn't Ben Bernanke the same guy who was chair of

the Fed last year and the year before? The same chair who completely

failed to see the coming credit crisis and global financial collapse?

And if that's the case, why on earth would investors take seriously

anything he says about the future direction of the economy?

You'd have to be in a state of glycemic overload to believe anyone

who told you that this recession, which is just starting to really roll

downhill, is going to be over by the end of 2009. Why, we're also

getting reports that earlier estimates that official unemployment this

year would hit 8 percent are far too low, and that it will actually be

closer to 9 and rising by year's end. (Real unemployment--that is as

measured the way the Dept. of Labor used to measure it before the

Carter administration changed the methodology to hide how bad things

were in the late 1970s--is about 18 percent already.)

We don't even know as of today what the fate of the three so-called

US automakers will be. One may end up sold, or partly sold to China,

one may go bust, and the other may be belly up a year from now. And as

for the banks, there are plenty of smart people who are pointing out

that banks like Citibank and B of A are really, at this point, zombies,

and that the government may end up, against its will, having to take

them over, break them apart, and sell off the parts that still float,

using the rest for kindling.

I'm no economic prognosticator, but I do know that this economy is

not about to bounce back. The whole American public is now in a

hunkered down, defensive position, hoarding money, worrying about

losing employment, struggling to pay bills. Consumers, whose activities accounted until recently for 72 percent of US GDP, have lost upwards of $8 trillion in lost investments and shriveled home equity. That's not an environment that sets the stage for a recovery.

Bernanke is talking through his hat.

The only rational reason to buy today on Bernanke's comment would

be if you surmised that the average investor is an idiot and would

likely buy based on the Fed chairman's comments. But then, of course,

you would only be buying to ride the short bump those comments would

cause, jumping back out soon afterwards, before common sense returned

and the market continued its downward slide.

Of course, looking more broadly, there is a theory that market

behavior can be predictive as a leading indicator. Major economic

downturns have generally been preceded by major market crashes (just as

recoveries have been preceded by market rises). We had a roughly 40%

crash in the market in 2008, which, judging from history, would be

predictive of a serious recession. But we've also had an additional

slump of 16-18 percent just since Jan. 1. In normal times that would

almost qualify as a "bear market" (a serious market crash, defined as a

fall of 20% over a two-month period) in itself, and as such, would be

considered a "leading indicator" of a coming economic slowdown.

Far be it for me to say investors know anything about the future

of the economy, but I'd guess that their longer-term lack of confidence

in the stock market is giving a far more accurate and honest assessment

of the likely direction of the US and global economy than Chairman

Bernanke's latest comments to Congress.

I'd also be willing to bet that they weren't taking Bernanke seriously in Congress or in the White House, where the whole premise of the stimulus packag--a two-year affair--is that things will not start to look better until at least the end of 2010 or sometime in 2011.

________________

DAVE LINDORFF is a Philadelphia-based journalist and columnist. His

latest book is "The Case for Impeachment" (St. Martin's Press, 2006 and

now available in paperback edition). His work is available at www.thiscantbehappening.net