When normal operations resume, the corporation would cease emergency subsistence payments, with employees paid at market-determined rates, with any increases coming from profits instead of increasing fixed wages and benefits.

Under this proposal, when a corporation becomes profitable, pre-tax profits paid out as dividends (tax-deductible to the corporation) would be paid through tax-sheltered employee ownership accounts to the loan-issuing commercial bank, thus canceling the corporation's indebtedness. As the loans are repaid, shares would be released from escrow and put into each employee's individual Employee Capital Homestead Account (ECHA), a vehicle similar to today's tax-sheltered Employee Stock Ownership Plan (ESOP) accounts. (ECHAs could later transition to full CHAs when the Capital Homestead Act for all citizens is passed and implemented.) Full-dividend payouts would be passed through (after reasonable deductions for bank administration costs) to each employee to use for consumption.

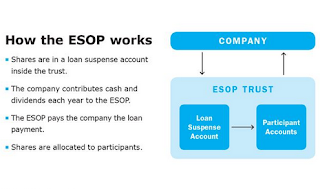

A politically practical alternative to creating a new legal vehicle (the ECHA) would be to channel government-guaranteed loans made through local banks to a company's Employee Stock Ownership Plan Trust. ESOPs, which are tax-advantaged corporate finance vehicles, are already recognized under United States law, and thus would not require additional Congressional approval. ESOPs can be used by any company incorporated as a C-Corporation or an S-Corporation. For purposes of receiving government-guaranteed loans for working capital or long-term growth capital, ESOPs should be required to issue and allocate new, full-dividend, voting shares to all employees on an equal basis.

The law allows a company to deduct from its taxable income any future profits used by the ESOP to pay for shares or distributed to employees through the ESOP. Banks assess the feasibility of a company's loan on the basis of the future stream of pre-tax profits, projected to be earned by the company within a reasonable period of years. The company's cash contributions and dividend payments to the ESOP repay the acquisition loan. Participants sell their shares to the ESOP for cash when they leave the company.

In a worst case scenario, in the event of loan default on the part of the corporation, the federal government making the emergency loan guarantee would repay the balance of the loan to the issuing commercial bank, in which case the loan is extinguished and the proceeds are used to redeem the commercial bank's paper (promissory note) from the Federal Reserve.

Since 1985 in the United States, commercial bank loans for industry, commerce, and agriculture that have gone bad typically have been between 1 and 5 percent (.federalreserve.gov/releases/chargeoff/delallsa.htm). Assuming that 5 percent of all government-insured commercial bank loans may default, a $2 trillion+ loan guarantee package would cost the government a lot less -- $100 billion or more depending on the total trillions of dollars guaranteed. The government can waive an insurance premium or, for example, charge a 1 percent premium, in which case the government would collect $20 billion and reduce the loss by that amount.

To produce emergency medical and other supplies needed during the COVID-19 pandemic new "emergency money" can be channeled to private sector businesses. Such money should flow as loans through the ESOP financing mechanism. The ESOP can create equal capital ownership opportunities for every employee in the companies producing the emergency supplies. The government would serve as the guarantor of those loans, and as the customer that purchases and distributes the emergency goods where needed.

In immediate and future time frames, we must ensure that federal government grants and loans do not end up with corporations whose controlling owners would buy back their stock, in order to reduce the number of shares so the remaining shareholders can consolidate more ownership, and buy up the assets auctioned off by corporations that go out of business during the pandemic. Otherwise, without ownership-broadening stipulations tied to grants and loans, the result will be the ownership of our nation's wealth will become even more concentrated than before the pandemic struck. Consequently, there will be more Americans poorer as poverty spreads while multi-millionaires and billionaires become wealthier.

Recovery Money Creation

As the economy recovers, all money backed by government debt should be gradually retired and replaced with money backed by private-sector productive capital assets.

After termination of emergency financing, EVERY citizen would be able to establish a Capital Homestead Account (CHA) that is legally advantaged to acquire new qualified full-dividend payout, voting shares of any corporation with fully insured, interest-free capital credit. A one-time premium to cover the risk of loan default as well as reasonable charges for the services of the central bank and bank lenders would be in addition to the principal to be repaid on capital credit loans to citizens. The corporations eligible would be both established and startups, and would use the money exclusively to fund viable projects to grow the economy. CHAs, as with the temporary ECHAs, would make the debt service payments with pre-tax dividends to Federal Reserve-backed commercial banks issuing the capital credit, and afterwards, upon liquidation, paid to citizen beneficiaries as regular taxable personal income.

As part of the normal money creation process, Federal Reserve policies should allow for covering reasonable and fair financing costs of the central bank and commercial banks providing interest-free capital credit loans annually and equally to EVERY citizen for the exclusive purpose of financing future capital expansion via corporations. If a corporation rejects citizen financing, they would not qualify for interest-free capital credit through the Federal Reserve/commercial banking system. Political and media pressure will help to persuade corporations to do the right thing and have ALL citizens share in our collective prosperity.

Our government recently announced, via Treasury Secretary Steven Mnuchin, it would take ownership stakes in airlines in exchange for grants. A better solution, similar to ECHA financing, would be for each citizen, as an individual, to have an equal ownership share in the particular airline as a result of the government's billions of dollars in grants to the airlines or any other industry to be bailed out.

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).