If the money is BORROWED into existence as it is

done in our current "debt based" monetary system, the money is created out of

thin air by the banks using the fractional reserve lending

system. This money is then a representation of debt and has a debt and interest

burden associated with it.

The way money is brought into circulation is at the

very heart of our problems. It turns out that in our "debt based" monetary

system, our entire money supply (except for coins) is created

when a loan is taken out. Once the loan is repaid, the money is removed from

circulation. This system unfortunately

has a fatal flaw that guarantees its ultimate collapse.

Let's assume that we are on an island with a totally

closed monetary system and you were to borrow $100 at 10% interest. You can pay

back the $100 principle because $100 was put into circulation as a result of

your loan. However, where will the $10 in interest payments come from if there

is no other money in circulation? The fact of the matter is that the loan must

default because there is not enough money in circulation to pay principal and

interest. Since the $100 in circulation is the result of the loan being taken

out. This $100 is placed as a liability on the bank's books. Once you have paid

off the loan, this liability is removed from the bank's ledger. That is how the money is extinguished

once you have repaid the principal on the loan. The only way to pay back the

interest on the loan is to borrow more money into circulation. Only the

principle is extinguished, the interest is not extinguished because the

interest was not a liability on the bank's ledger. The interest amount ends up

in the pockets of the bankers. If someone takes

out additional loans

to cover the interest charges, it will only delay the day of reckoning. Ultimately

you will have an even higher interest burden that can never be repaid. Doesn't this sound familiar to the economic

situation we currently find ourselves in?

Of course our monetary system has millions of

people, taking out loans, making payments and doing other transactions all of

the time. However, the fact remains that you can only repay a loan with

interest if you or someone else takes out a loan to place additional money into

circulation. The problem is that now someone else will have a loan to repay and

will also need additional money in circulation to pay for their interest

charges. So the debt burden for the money to pay the interest payment on your

loan has been shifted to someone else,

and over time the interest burden continues to grow. It becomes quickly obvious

that as a nation we must constantly be in debt in order to service the interest

charges on our money supply. As time passes, this debt overhang with its

associated compounding interest charges becomes a larger and larger burden on

the society, eventually reaching a level that is no longer sustainable as it is

becoming today.

The other fatal flaw in this system is that in order

for the money supply to keep up with the growth in the economy, we must also continue

to grow the debt in order to grow the money supply. Some of those clueless

politicians represented by the first doctor we visited at the beginning of this

article think we should pay off the debt. What they do not realize is that if

the debt was ever totally paid down, there would be no money in circulation. Our

current "debt based" monetary system is the DISEASE. Until we change

our monetary system from "debt based" to "wealth based", we can never pay off

the debt, because if we did, there would be no money in circulation. The

patient would die!

Think about this example of the insanity of the

current system. If a government wants to build a bridge, instead of printing

and then SPENDING the money into the economy with no interest bearing debt

associated with it, the government instead goes to the bankers and BORROWS the

money into existence. By BORROWING the money into existence, the government

incurs interest charges which means that over the term of loan the government

will pay more money for this bridge in finance charges than it pays for the

materials and for the labor for the project. This financing cost of "debt

based" money is then passed on to everyone.

In a "wealth based" system, the government would SPEND

the money into existence, rather than BORROW it into existence. The costs of

all infrastructure projects could be cut by more than half. This fact should

resonate to those of you with a home mortgage, once your mortgage is paid off,

the interest charges have easily exceeded the original cost of your home. The

same thing is happening to all of our infrastructure projects. The financial

class is profiting immensely from our

current "debt based" system.

So, is a "wealth based" monetary system some utopian vision of what has never been and can never be? The answer is no. In our colonial past we had colonial scrip where the government SPENT the money into existence. Our colonies were prospering at that time. David Hayes writes about Benjamin Franklin during a visit to England:

The English officials

asked how it was the Colonies managed to collect enough taxes to build poor houses,

and how they were able to handle the great burden of caring for the poor.

Franklin's reply was most revealing: "We have no poor houses in the

Colonies, and if we had, we would have no one to put in them, as in the

Colonies there is not a single unemployed man, no poor and no vagabonds."

Think long and hard about this. In the American colonies before the American

Revolution, there was "not a single unemployed man, no poor and no

vagabonds". -- no one on Welfare, no one on Social Security, no homeless,

no income tax, no alphabet agencies, No IRS, BATF, FBI, DEA, CIA, HEW, OSHA,

SBA, and on and on and on to provide for the "general welfare" of our

villages, towns, cities and states. How did Benjamin Franklin explain this to

the British officials of his day?

How would he explain it to today's lawyers, judges, politicians and other

government officials? "It is because, in the Colonies, we issue our own

paper money. We call it Colonial Script, and we issue only enough to move all

goods freely from the producers to the Consumers; and as we create our money,

we control the purchasing power of money, and have no interest to pay."

The colonies did not have this problem because they

used "wealth based" money that had need SPENT into circulation. This caught the

attention of the English bankers. They had laws passed that prohibited the

colonies from using their "wealth based" currency and mandated that "debt

based" currency should be used. Within a year after passage of these laws, the

colonies found themselves with mass unemployment and beggars as Franklin had

found in England. This suffering brought on by a "debt based" currency was the trigger

for the Revolutionary War. Unfortunately, even after the Revolutionary War, the

monetary system remained "debt based" and except for brief periods of time we

never returned to a "wealth based" currency.

"The money powers prey upon the nation in times of peace and

conspire against it in times of adversity. It is more despotic than a monarch,

more insolent than autocracy, and more selfish than a bureaucracy. It

denounces, as public enemies, all who question its methods or throw light upon

its crimes. I have two great enemies, the Southern Army in front of me and the

bankers in the rear. Of the two, the one at the rear is my greatest foe."

Abraham Lincoln

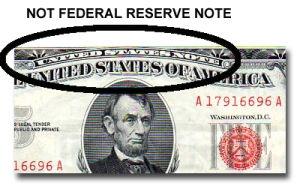

In fact, Lincoln did exactly what the founding

fathers had envisioned for the Republic when they specified that "only Congress

shall have the right to coin money". We all know what happened to Lincoln after

the war.

We

all know what happened to

Kennedy a few months after signing that executive order.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).