- On Feb. 12, China's state-owned metals giant Chinalco signed a $19.5 billion deal with Australia's Rio Tinto (RTP) that will eventually double its stake in the world's second-largest mining company.

- On Feb. 17 and 18, China National Petroleum signed separate agreements with Russia and Venezuela under which China would provide $25 billion and $4 billion in loans, respectively, in exchange for long-term commitments to supply oil.

- On Feb. 19, the China Development Bank struck a similar deal with Petrobras (PBR), the Brazilian oil company, agreeing to a loan of $10 billion in exchange for oil.

- Iran announced that it had signed a $3.2 billion agreement with a Chinese consortium to develop an area beneath the Persian Gulf seabed that is believed to hold about 8 percent of the world's reserves of natural gas.

The Chinese have a long-term plan to rule the world. They are buying up natural resources throughout the world. The walls are closing in on the U.S. The U.S. solution is to print more dollars, borrow from future generations, and tax their citizens more. Ben Bernanke has rolled the dice, but the fear is in his eyes, not our enemies’. We will shortly realize that our castles were built upon pillars of salt and pillars of sand.

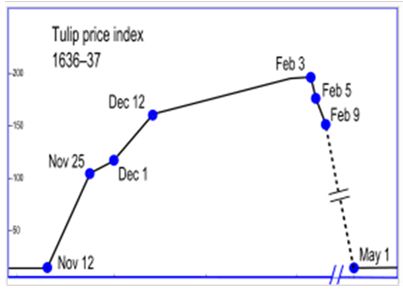

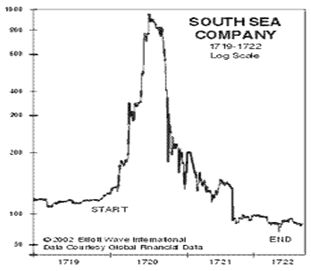

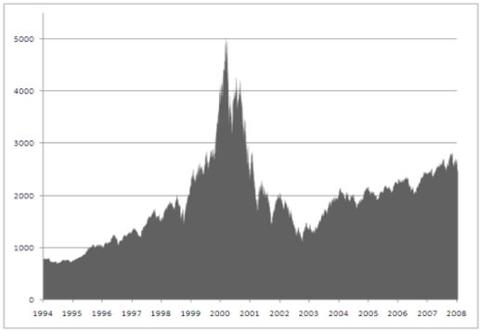

Bubble, BubbleNever in the history of the world has a bubble burst halfway. Every bubble has collapsed to its starting point or below. The self serving pundits on CNBC and on Sunday talk shows continue to predict a stabilization of the housing market. They are wrong. The bubble is still deflating and will not end until home values are back to 2000 levels, if we’re lucky. Examples of bubbles that fully deflated include the tulip bubble of 1637 - 1638, the South Sea bubble of 1719 - 1722, the Nikkei bubble from 1983 until today, and the NASDAQ bubble from 1999 – 2003. The United States has three bubbles that are deflating simultaneously, compliments of the Federal Reserve, George Bush, and a criminally incompetent Congress. Housing, consumer spending, and U.S. total debt are all at different phases of bubble deflation. No matter what politicians attempt, these bubbles cannot be re-inflated. They will deflate fully.

It is a characteristic of wisdom not to do desperate things.

--Henry David Thoreau

Tulip mania struck Holland in 1637. The whole nation was consumed by tulip bulbs in the first recorded speculative bubble. Contract prices for tulip bulbs reached astronomical levels and then suddenly collapsed. At the peak of tulip mania in February 1637, tulip contracts sold for more than 10 times the annual income of a skilled craftsman. In a matter of seven months, fortunes were made and lost. The bubble popped completely.

Source: mysmp.comThe South Sea Company was the AIG of the 1700’s. It was a British joint stock company, founded in 1711. The company was granted a monopoly to trade as part of a treaty during the War of Spanish Succession. The company assumed the national debt England had incurred during the war. In 1719 the company proposed a scheme by which it would buy more than half the national debt of Britain (£30,981,712), again with new shares, and a promise to the government that the debt would be converted to a lower interest rate, 5% until 1727 and 4% per year thereafter. The purpose of this conversion was similar to allow a conversion of high-interest but difficult-to-trade debt into low-interest, readily marketable debt and shares of the South Sea Company. These are the games that declining empires play when they have overreached in their empire building. The plan sounds a lot like Timmy Geithner’s Good Bank Bad Bank scheme. Shuffling debt from one entity to another entity doesn’t get rid of it. It is just a scam paid for by taxpayers.

Any fool can make a rule, and any fool will mind it.

--Henry David Thoreau

The price of South Sea Company stock went up from £100 a share to almost £1,000 per share. Its success caused a country-wide investing frenzy by peasants, businessmen and lords. The price reached £1,000 in early August and the level of selling was such that the price started to fall, dropping back to £100 per share before the year was out, triggering bankruptcy among those who had bought on credit. The English Parliament reacted to the crisis exactly the way our current clueless bunch of moron Congressmen are reacting to the AIG debacle. The estates of the directors of the South Sea Company were confiscated and used to relieve the suffering of the victims, and the stock of the South Sea Company was divided between the Bank of England and East India Company. A resolution was proposed in parliament that bankers be tied up in sacks filled with snakes and tipped into the Thames River. I’m sure Barney Frank is preparing a similar resolution regarding AIG executives. No one can calculate the madness of men.

Source: Elliott WaveJapan Inc. was going to dominate the world. From 1983 until its peak in 1989, the Nikkei rose from 7,500 to 38,900, a 500% increase in seven years. Following World War II, Japan implemented tariffs that protected their industries from overseas competition. This resulted in large trade surpluses and an appreciating yen. With artificial protections, Japanese companies made mal-investments. Easy money and false confidence led to a frenzy in the stock market and real estate market. Japanese banks had financed this speculative bubble with high risk loans. The PE ratio of the Nikkei reached 78 in 1989. Twenty years after this peak, the Nikkei hit a low of 7,500 this year, the same level it started at in 1983. This has occurred despite spending billions on make work stimulus programs, reducing interest rates to zero, and artificially reducing the value of the yen. The ultimate outcome has been a national debt that is 150% of GDP with a rapidly aging population and no way out. See any similarities?

Source: Mike ShedlockTo prove that Japan didn’t have a monopoly on foolishness and speculative frenzy, the U.S. had their bubble in 1999 and 2000. The NASDAQ market rose from 1,000 in 1996 to 5,132 in 2000. The introduction of the internet convinced millions that we had entered a new era. Wall Street did what it does best, and hyped the can’t miss riches to be gained from investing in any company that added a dot.com to their name. When AOL acquired Time Warner (TWX) in January 2000, the top was marked. The over-hyped fear of the Y2K “disaster” that awaited our worldwide computer systems resulted in a surge of computer purchases. Alan Greenspan did what he did best and flooded the system with liquidity. These all combined to produce a blow-off top in March 2000. The PE ratio of the NASDAQ reached 264, as most of the hyped dot.com stocks had no earnings. Nine years later, the NASDAQ stands at 1,457, 72% below its peak at 1998 levels. The bubble burst fully.

NASDAQ Dot.Com Bubble

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).

- On Feb. 17 and 18, China National Petroleum signed separate agreements with Russia and Venezuela under which China would provide $25 billion and $4 billion in loans, respectively, in exchange for long-term commitments to supply oil.

WHEN AMERICA RULED THE WORLDBy Jim Quinn (Page 2 of 5 pages) Become a premium member to see this article and all articles as one long page. 3 comments

|

|

|

Rate It | View Ratings |

James Quinn is a senior director of strategic planning for a major university.

James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of (more...)

The views expressed herein are the sole responsibility of the author

and do not necessarily reflect those of this website or its editors.

OpEdNews depends upon can't survive without your help.

If you value this article and the work of OpEdNews, please either Donate or Purchase a premium membership.

STAY IN THE KNOW

If you've enjoyed this, sign up for our daily or weekly newsletter to get lots of great progressive content.

If you've enjoyed this, sign up for our daily or weekly newsletter to get lots of great progressive content.

To View Comments or Join the Conversation: