|

SHARE |

|

Gerald E. Scorse is a freelance writer living in New York. His op-eds have appeared in newspapers across the United States

OpEdNews Member for 587 week(s) and 2 day(s)

49 Articles, 0 Quick Links, 109 Comments, 1 Diaries, 1 Series, 0 Polls

Articles Listed By Date

List By Popularity

List By Popularity

Page 1 of 3 First Last Back Next 2 3 View All

SHARE  Saturday, January 3, 2026

Saturday, January 3, 2026

Tax unfairness soars under Donald Trump This article demonstrates how the rich, richer and richest Americans benefit from the tax code--and have benefitted even more during the two Trump presidencies.

Tax unfairness soars under Donald Trump This article demonstrates how the rich, richer and richest Americans benefit from the tax code--and have benefitted even more during the two Trump presidencies.

(1 comments) SHARE  Friday, October 18, 2024

Friday, October 18, 2024

Election 2024 could stir up another witch's brew You might think nothing could match the current presidential campaign. You might, but you'd be wrong: it's very much like 2016. Let's just hope it ends differently.

Election 2024 could stir up another witch's brew You might think nothing could match the current presidential campaign. You might, but you'd be wrong: it's very much like 2016. Let's just hope it ends differently.

(2 comments) SHARE  Tuesday, June 11, 2024

Tuesday, June 11, 2024

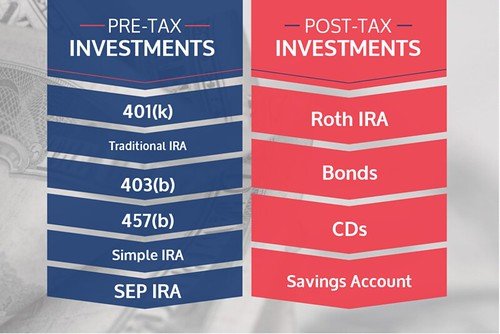

The overlooked truths of retirement accounts Retirement accounts have been endlessly criticized ever since they were first created. Are Americans by the tens of millions putting their hard-earned dollars in the wrong places? Or is it the critics who've been making the mistake?

The overlooked truths of retirement accounts Retirement accounts have been endlessly criticized ever since they were first created. Are Americans by the tens of millions putting their hard-earned dollars in the wrong places? Or is it the critics who've been making the mistake?

(1 comments) SHARE  Wednesday, February 14, 2024

Wednesday, February 14, 2024

Americans deserve fairer Social Security taxes There's no question that Congress will fix Social Security before the trust fund runs dry in 2033. The only real question is, what form will the fix take. As it's been ever since the beginning, Democrats and Republicans have sharply different ideas.

Americans deserve fairer Social Security taxes There's no question that Congress will fix Social Security before the trust fund runs dry in 2033. The only real question is, what form will the fix take. As it's been ever since the beginning, Democrats and Republicans have sharply different ideas.

(1 comments) SHARE  Tuesday, December 5, 2023

Tuesday, December 5, 2023

Baseball owners blow off fans in favor of streaming dollars Slowly, shamefully, baseball fans are being mistreated: unless they subscribe to certain streaming services, they aren't able to see certain games (including playoff games).

Baseball owners blow off fans in favor of streaming dollars Slowly, shamefully, baseball fans are being mistreated: unless they subscribe to certain streaming services, they aren't able to see certain games (including playoff games).

(4 comments) SHARE  Tuesday, October 31, 2023

Tuesday, October 31, 2023

Taxes in America are unfair to most Americans Income taxes in America have been unfair from the beginning, and it's gotten seriously worse from the Reagan era onward. Here's a bit of the history, some of the worst abuses, and a few reform suggestions from tax experts.

Taxes in America are unfair to most Americans Income taxes in America have been unfair from the beginning, and it's gotten seriously worse from the Reagan era onward. Here's a bit of the history, some of the worst abuses, and a few reform suggestions from tax experts.

(1 comments) SHARE  Saturday, August 12, 2023

Saturday, August 12, 2023

Foolishness, hypocrisy, the GOP and the IRS Republicans always point to spending as the No. 1 cause for the federal deficit. For various reasons, all having to do with foolishness and hypocrisy, it's closer to the truth to suggest that Republicans themselves are the No. 1 cause.

Foolishness, hypocrisy, the GOP and the IRS Republicans always point to spending as the No. 1 cause for the federal deficit. For various reasons, all having to do with foolishness and hypocrisy, it's closer to the truth to suggest that Republicans themselves are the No. 1 cause.

(7 comments) SHARE  Monday, July 3, 2023

Monday, July 3, 2023

My love affair with print newspapers The decline and possible extinction of print newspapers has been a sad thing to watch. For the writer, it's been particularly sad: he has to decide between a new technology and one he's lived with, and loved, for decades.

My love affair with print newspapers The decline and possible extinction of print newspapers has been a sad thing to watch. For the writer, it's been particularly sad: he has to decide between a new technology and one he's lived with, and loved, for decades.

(3 comments) SHARE  Monday, April 24, 2023

Monday, April 24, 2023

The 75-year thievery of joint tax returns There's no good reason to have joint tax returns. The only thing they're really good for is to perpetuate tax unfairness.

The 75-year thievery of joint tax returns There's no good reason to have joint tax returns. The only thing they're really good for is to perpetuate tax unfairness.

(2 comments) SHARE  Friday, January 6, 2023

Friday, January 6, 2023

IRS winks at $50 billion tax giveaway to the rich Congress is constantly handing out tax breaks to the rich. Now the IRS has gotten into the act, sanctioning state laws that give millionaires a way around the $10,000 SALT deduction limit that was part of President Trump's 2017 tax bill.

IRS winks at $50 billion tax giveaway to the rich Congress is constantly handing out tax breaks to the rich. Now the IRS has gotten into the act, sanctioning state laws that give millionaires a way around the $10,000 SALT deduction limit that was part of President Trump's 2017 tax bill.

(2 comments) SHARE  Saturday, October 15, 2022

Saturday, October 15, 2022

Crucial choices ahead for beloved, besieged Social Security Social Security affects a greater number of Americans than any other government program. A combination of factors (including the sharp right turn of the Republican party) has put its future in danger.

Crucial choices ahead for beloved, besieged Social Security Social Security affects a greater number of Americans than any other government program. A combination of factors (including the sharp right turn of the Republican party) has put its future in danger.

(1 comments) SHARE  Monday, July 25, 2022

Monday, July 25, 2022

Tax breaks helping the rich get richer Tax policy should always aim for tax fairness. Unfortunately, Congress is especially good at finding ways to do exactly the opposite. It's continually creating tax breaks that favor people with money. One of the worst is taxing capital gains at a lower rate than income from work. A new "worst," now before the Senate, would push back the age for required minimum distributions from 72 to 75.

Tax breaks helping the rich get richer Tax policy should always aim for tax fairness. Unfortunately, Congress is especially good at finding ways to do exactly the opposite. It's continually creating tax breaks that favor people with money. One of the worst is taxing capital gains at a lower rate than income from work. A new "worst," now before the Senate, would push back the age for required minimum distributions from 72 to 75.

(1 comments) SHARE  Friday, April 15, 2022

Friday, April 15, 2022

Two pathways to a major tax reform Among dozens of tax loopholes, the stepped-up basis is one of the costliest and most egregious. President Biden and law professor Daniel J. Hemel are backing separate and distinct ways to bring the giveaway to an end.

Two pathways to a major tax reform Among dozens of tax loopholes, the stepped-up basis is one of the costliest and most egregious. President Biden and law professor Daniel J. Hemel are backing separate and distinct ways to bring the giveaway to an end.

(10 comments) SHARE  Tuesday, November 30, 2021

Tuesday, November 30, 2021

Manchin's better way to pay for Build Back Better Build Back Better promises to significantly add to and improve America's social safety net. At the same time, millions of our most affluent taxpayers have been promised not to worry about any new taxes. That makes no sense--fiscally, morally, or any other way. As we seem to have forgotten, we're all in this together.

Manchin's better way to pay for Build Back Better Build Back Better promises to significantly add to and improve America's social safety net. At the same time, millions of our most affluent taxpayers have been promised not to worry about any new taxes. That makes no sense--fiscally, morally, or any other way. As we seem to have forgotten, we're all in this together.

(1 comments) SHARE  Wednesday, September 22, 2021

Wednesday, September 22, 2021

Biden: Tilt taxes to the middle class The presidency of Ronald Reagan marked the beginning of a tax system highly favorable to the rich. President Joe Biden wants to go in a different direction, but he first needs the approval of Congress. We'll soon see whether he gets it.

Biden: Tilt taxes to the middle class The presidency of Ronald Reagan marked the beginning of a tax system highly favorable to the rich. President Joe Biden wants to go in a different direction, but he first needs the approval of Congress. We'll soon see whether he gets it.

(3 comments) SHARE  Tuesday, August 3, 2021

Tuesday, August 3, 2021

The real, untold story of Roth IRAs If there were ever a contest for most unnecessary legislation, the creation of Roth retirement accounts could easily top the list. There was never any good reason for Roths. They're just one more in a long, long list of tax breaks created by Congress for people in no need of tax breaks. .

The real, untold story of Roth IRAs If there were ever a contest for most unnecessary legislation, the creation of Roth retirement accounts could easily top the list. There was never any good reason for Roths. They're just one more in a long, long list of tax breaks created by Congress for people in no need of tax breaks. .

(1 comments) SHARE  Thursday, June 17, 2021

Thursday, June 17, 2021

Nobody dodges taxes like the super-rich Our tax code may be progressive on its face, but the super-rich could care less. They draw on their riches to beat the code, and they're beating it by the billions.

Nobody dodges taxes like the super-rich Our tax code may be progressive on its face, but the super-rich could care less. They draw on their riches to beat the code, and they're beating it by the billions.

(1 comments) SHARE  Saturday, April 24, 2021

Saturday, April 24, 2021

When the rich don't pay, the rest of us do The IRS gets the income figures for most Americans from the companies they work for. Millions of others, though, do their own income reporting. If a bill now before Congress becomes law, the agency will get third-party income information for the first time for millions of high-income taxpayers who currently self-report.

When the rich don't pay, the rest of us do The IRS gets the income figures for most Americans from the companies they work for. Millions of others, though, do their own income reporting. If a bill now before Congress becomes law, the agency will get third-party income information for the first time for millions of high-income taxpayers who currently self-report.

(3 comments) SHARE  Monday, March 8, 2021

Monday, March 8, 2021

Congress's soft spot for rich retirees Tax breaks usually have some reason for being, but here's one that doesn't: a proposal to raise, for the second time in two years, the beginning age for required minimum distributions from retirement accounts (RMDs). The original age was already too late, the current age of 72 is worse, but the proposed new age of 75 takes Congressional giveaways to a whole new level.

Congress's soft spot for rich retirees Tax breaks usually have some reason for being, but here's one that doesn't: a proposal to raise, for the second time in two years, the beginning age for required minimum distributions from retirement accounts (RMDs). The original age was already too late, the current age of 72 is worse, but the proposed new age of 75 takes Congressional giveaways to a whole new level.

(1 comments) SHARE  Sunday, January 3, 2021

Sunday, January 3, 2021

The numbers add up for 'child-side' tax policies Tax breaks go overwhelmingly to those in the upper incomes. According to two Harvard researchers, a greater proportion of those monies might better be directed to low-income families and their kids. The initials of their concept are MVPF, short for Maximum Value of Public Funds.

The numbers add up for 'child-side' tax policies Tax breaks go overwhelmingly to those in the upper incomes. According to two Harvard researchers, a greater proportion of those monies might better be directed to low-income families and their kids. The initials of their concept are MVPF, short for Maximum Value of Public Funds.