Under Pinto's approach, any loan to a borrower with a FICO score below 660 is "subprime," period. Similarly, Pinto deems any loan originated with a combined loan-to-value of 90% or more--say, an 80% first lien, 10% second lien--to be "Alt-A," period. Similarly, any loan with an initial below-market teaser rate is Alt-A, period.

Pinto's categorizations are, to put it charitably, misleading because they obscure the impact of the GSEs' credit practices, which were to limit exposure to loans that had not been adequately underwritten with full documentation and consideration of a borrower's ability to pay. A fully conforming fixed-rate 70%-LTV mortgage loan, originated with full documentation to a borrower with a 650 FICO score, is not normally considered subprime. Similarly, a fully conforming fixed-rate 90%-LTV mortgage loan, originated with full documentation to a borrower with a 790 FICO score, is not normally considered Alt-A. Also, any GSE financing in excess of 80% is covered by private mortgage insurance; Fannie and Freddie are not allowed assume credit risk beyond 80% of a home's appraised value. Most Alt-A loans, under everyone else's definition of the term, are low-documentation, or liar loans.

Private Label Deals Are Exponentially Worse

Data released by the FHFA, which compares GSE loan performance with that of private label deals, highlights the reason why everyone else's definitions are more edifying. The FHFA compared loans according to four salient criteria: FICO scores, LTV at closing, vintage (year of origination), fixed-rate versus ARMs. The overwhelming majority of GSE mortgages were fixed-rate, whereas the overwhelming majority of loans packaged by Wall Street into private label mortgage securitizations were adjustable-rate. ARMs--both prime and nonprime-- performed exponentially worse. Overall, the private label deals had delinquency rates that were four to five times higher. When compared on an apples-and-apples basis, the GSE loans almost always performed better than those in private label deals.

The FHFA data points to one of the fatal flaws in private label securitizations, which became apparent when home prices started falling. The deals were structured so that no one could act like a bank; that is, it was difficult, if not impossible, for somebody to come in and negotiate loan workouts with the borrowers. With these deals, no one is really in charge of maximizing loan recovery, and conflicts of interest abound. Nobody knows who really owns the different securitization tranches, or who is betting on failure through a secret credit default swap. Private labels deals, at least those outside of GSE lending guidelines, did not really exist during the last real estate downturn in the early 1990s. But again, the issue of wall street promoting flawed structures is banished from AEI/GOP universe.

Once Again, Debunking The Fannie/Freddie Myths

Needless to say, Pinto's skewed analysis, which argues that the slide in lending standards was driven by the GSEs, is refuted by various studies, such as "Understanding The Boom And Bust In Nonprime Mortgage Lending," which was prepared at Harvard with the assistance of advisors from the FDIC, the Federal Reserve and elsewhere. The study used data produced under the Home Mortgage Disclosure Act. It dispels the myth that subprime loans (using the non-Pinto definition) were synonymous with low-income borrowers. Circling back to an earlier quote:

Nonprime mortgage growth in the first half of the 2000s was explosive as measured by dollar volume and as a share of refinance and home purchase loans (Figure 1-3). Subprime mortgage loans moved from being a niche product to being widely distributed to borrowers of all income levels beginning in 2000. Though a disproportionate share of subprime mortgages were originated to lower income and minority households, the majority of all such loans were taken out by middle-income white households. Even at the peak in 2005, Home Mortgage Disclosure Act data shows that only about a quarter of all higher-priced home purchase loans were made in low-income communities, only a third in majority-minority communities, and only a fifth in low-income majority-minority communities. [Emphasis added.] p.38.

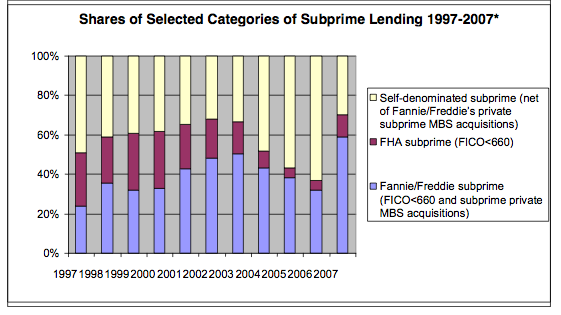

It also refutes the idea that nonprime mortgages, (again the non-Pinto definition), were dominated by the GSEs:

HMDA data suggests that the GSEs directly purchased only 1.7 percent of the 1.3 million higher-price loans issued in 2004. Higher-price loan specialists sold only one-tenth of a percent of their loans directly to the GSEs, but 64 percent of their loans to private conduits.Information reported under the Home Mortgage Disclosure Act provides a window on the mortgage market in 2005...It also reveals just how little higher price lending was done by CRA lenders in their assessment areas and how much more likely higher priced loans were to be sold into private label securities than held in portfolio or sold to Fannie Mae and Freddie Mac. [Emphasis added.] p.44.

That's why it makes no sense to conflate the toxic mortgages packaged by Wall Street with the distressed loans extended by the GSEs.

Distracting Away From A Legacy of Failure

Why is Wallison so invested in this conflation? Because, as a member of the Shadow Financial Regulatory Committee of the American Enterprise Institute, he spent the last nine years advocating policies that promoted the spread of toxic mortgages and denying the damage that they caused. Check out the Shadow Committee statements here, here, here, and here.

If you suspect that Wallison learned anything from the FCIC hearings on mortgage fraud, watch this.

Clarification/Correction: Recently, I stumbled upon an article in About.com that misquoted an article written by Wallison and Charles Calomiris about losses at Fannie and Freddie. The misquote had gone viral, in part because the presentation of numbers was somewhat misleading. So I wrote an article in this site and elsewhere wrongly claiming that Wallison and Calomiris, "lied" about that particular data. Upon correcting my mistake, I suggested that Wallison intended to mislead others with his presentation of his numbers. At that time, I neglected to mention that my belief was based in part on the numerous false and misleading claims that Wallison had made elsewhere. I regret the error.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).