Out of concern that, "mortgages with predatory features undermine homeownership by low-and moderate-income families in derogation of the GSEs' Charter missions," (65 FR 65069, Oct. 31, 2000), Cuomo's HUD excluded ''Mortgages contrary to good lending practices,'' from being counted toward meeting Affordable Housing Goals (65 FR 65085). HUD also said it would also exclude "B&C loans" (i.e. subprime loans) from its calculation of the size of the overall market. (65 FR 65090).

The new regulations specifically excluded loans with: (a) Excessive fees, (b) Prepayment penalties, (c) Single premium credit life insurance, (or d) Evidence that the lender did not adequately consider the borrower's ability to make payments, plus any loans that the HUD secretary deemed to violate good lending practices. The GSEs could not include any loans from any lenders that steered prime borrowers to higher priced subprime products, or, acting as a loan servicer, failed to accurately report a borrower's repayment history.

Cuomo's exclusion of prepayment penalties, with limited carve-outs, made it almost impossible to buy into a mortgage securitization -- subprime or otherwise -- comprised of ARMs. Investors and rating agencies demand those penalties as an offset the prepayment risk in a static loan pool. Otherwise, creditworthy borrowers would refinance whenever rates moved in their favor, while the weaker borrowers, who could not refinance, worsened the default rate.

Private Label Deals Are The Worst

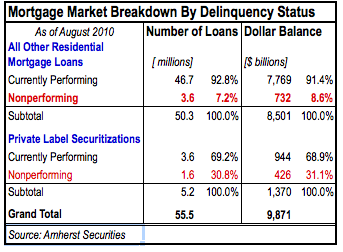

Cuomo's regulations stood the test of time because mortgages financed by Wall Street's private label securitizations performed exponentially worse that the rest of the market. A report from Amherst Securities divides mortgages between private label securitizations and everything else, including GSE loans. For private label deals, the rate of nonperformance is 31.1%; for all other mortgages, it's 8.6%. An FHFA comparison between GSE and private label loan performance confirms that:

The relatively worse performance of private-label MBS-financed mortgages was consistent across origination years and, within each year, across nearly all groups of loans with similar LTV ratios and FICO scores.

Violating the Spirit of Anti-Predatory Regs

Whether or not the GSEs followed the spirit and letter of those regulations is an entirely different matter. Then there's the question of whether the Bush Administration exerted any effort to enforce the regulations against predatory lending or the laws against mortgage fraud.

Interest-only loans or option ARMs, which make principal paydown optional, seem no less predatory than the products that Cuomo specifically excluded. These products have no legitimate business purpose. Consider a $100,000 amortizing mortgage with 6% interest. The monthly installments are $600. The installments on an interest-only loan are $500. If you can't handle that $100 difference, then you can't handle an upward shift in short-term interest rates, or a decline in the value of your home.

Alt-A should not be conflated with subprime. Look for a definition of Alt-A or subprime and you'll most likely get a fuzzy answer. Both segments show off high levels of fraud and high delinquency and default rates. But they are intended for very different market segments. In general, Alt-A borrowers have high FICO scores -- they are normally categorized as "A" rated -- and they finance less than 80% of the appraised value. At year-end 2008, the average FICO scores of Fannie's and Freddie's Alt-A loans, 719 and 725 respectively, were almost identical to that of their overall portfolio balances, and they financed, on average, 72% of the appraised property value. The key distinguishing characteristic about alt-A loan packages is that they have low documentation. The source of the of the borrower's income is frequently not confirmed. In addition, if the Alt-A loan were originated from a non-bank lender, the transaction would have escaped the scrutiny of anti-money laundering rules, which required documentation of the source of the initial down payment. In other words, the deal bypassed two key protections against fraud. The sources of credit comfort aren't necessarily worth much, since FICO scores can be rigged, and home appraisals can be inflated.

FICO scores are not based on income, which is why subprime borrowers should not be equated with low-income borrowers. Subprime is almost always defined as a borrower below a certain FICO cutoff. Moody's categorized mortgages according to FICO score: Subprime was below 625, Midprime was 625 - 700, Prime was above 700. The weighted average FICO of the ABX subprime indices was around 630.

Fannie and Freddie's originations, as segmented by FICO scores, were remarkably stable. And the overwhelming majority of loans in all categories were fixed-rate. The problem was that, within the subset of ARMs and among the high-FICO borrowers, they offered the worst types of loan products. Those loans definitely did not fit the requirements for the GSEs' Affordable Housing Goals.

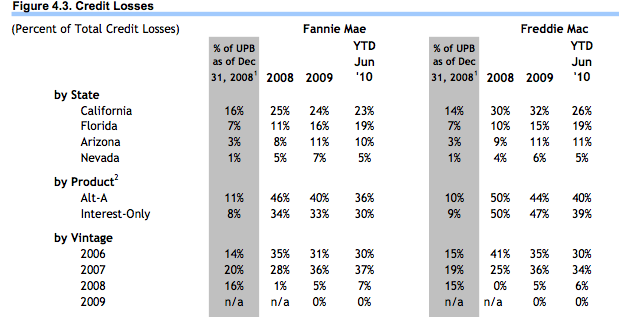

How the Worst Loans Overlapped

The FHFA laid out what went wrong. First, it confirmed the two immutable rules of real estate lending: 1. Location, location, location; and 2. Timing is everything. That is, the biggest losses were in the states which saw the biggest price declines, and the biggest losses were from loans booked close to the peak of the bubble, which was around June 2006. All these categories overlap. A disproportionate share of Alt-A loans were booked near the peak of the bubble in states which saw the biggest price declines, and a disproportionate share of those loans were ARMs or interest-only.

The Private Sector Enabled Fannie and Freddie To Lay Off The Risk

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).