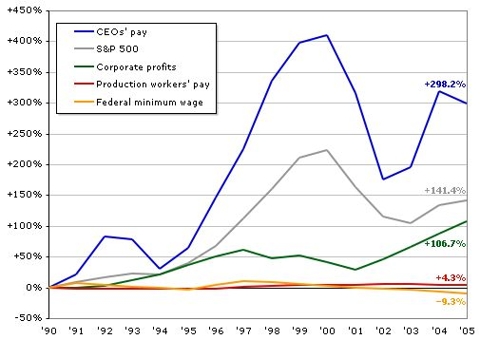

Source: Executive Excess 2006, 13th annual CEO Compensation Survey

The brutal necessary lesson that should have been learned is that if you loan money to people who can’t pay you back, your bank will go bankrupt. The “poor” people who made a bad decision in buying homes and cars they couldn’t afford have lost those homes and cars. The banks made a bad business decision in making those loans. The taxpayer was not involved in these business transactions. This is where Hank Paulson, Ben Bernanke and George Bush, formerly free market capitalists, decided to commit our grandchildren’s money to bailing out the horribly run financial institutions.

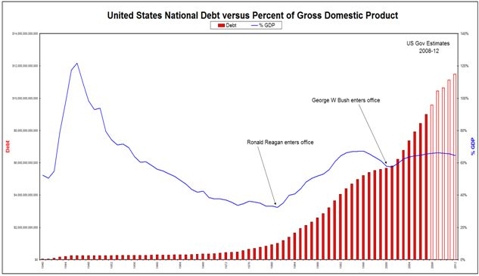

Our government has chosen to allow these banks off the hook for their bad business decisions at the expense of taxpayers. Rewarding bad decisions and bad behavior will lead to more bad decisions and more bad behavior. The government has made a dreadful decision that will haunt our country for generations. Now the Federal Reserve has lowered interest rates to 1% again. This is where this horrible nightmare started. The massive printing of currency throughout the world will ultimately lead to a hyperinflationary bust. The law of unintended consequences can be devastating.

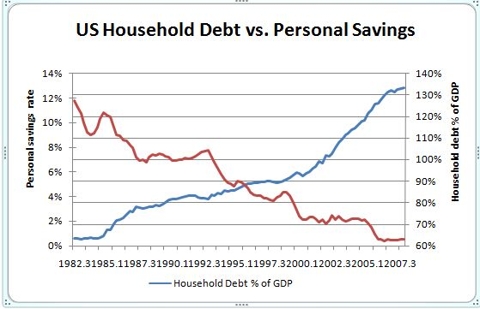

Early in the 1st Reagan administration, Americans saved 12% of their income and household debt as a percentage of GDP was 63%. In 1980, the oldest Baby Boomers turned 34. They entered their prime earnings and spending years. This is when something went haywire with our great country. Deficit spending became fashionable for government, corporations and individuals. Dick “deficits don’t matter” Cheney was probably in his glory as the country ran up deficits of money, morals, and brains. The Boomers and our government chose to try and borrow and spend their way to prosperity. As we now know, Mr. Cheney’s advice about deficits not mattering was about as good as his belief that you can fire a shotgun in any direction without implications. The Boomer generation has freely made choices over the last quarter century that has brought us to the brink of a second Great Depression.

During the current Bush administration, Americans’ savings rate actually went below zero, while household debt as a percentage of GDP soared above 130%, a doubling in 25 years. These figures prove that the apparent prosperity of the last 25 years was an illusion. Beginning in 1982, Baby Boomers chose to take the easy road. Saving, investing and living within your means were cast aside as “Old School”. Boomers were handed a better future through the blood, sweat and tears of the “Greatest Generation”. Through their hubris, they’ve squandered that better future, the future of their children and imperiled our entire capitalist system. Between 1989 and 2007, credit-card debt soared from $238 billion to $937 billion, a 300% increase. Household liabilities that are in delinquency or default totaled $775 billion at the end of June, according to CreditForecast.com data. This is equal to 7.5% of all U.S. household debt, up from 3% just two years ago.

In the last five years, our live-for-today Boomers sucked over $3 trillion of equity out of their homes to fund their selfish lifestyles. At the end of June, there were 2.72 million mortgage loans in default at an annualized rate. For all of 2008, defaults will hit 3 million, up from approximately 1.5 million in 2007, and 1 million in 2006.

What “essentials” do the Boomers invest all this borrowed money in every year? The U.S. Census bureau provides the answers:

- $200 billion on furniture, appliances ($1,900 per household annually)

- $400 billion on vehicle purchases ($3,800 per household annually)

- $425 billion at restaurants ($4,000 per household annually)

- $9 billion at Starbucks (SBUX) ($85 per household annually)

- $250 billion on clothing ($2,400 per household annually)

- $100 billion on electronics ($950 per household annually)

- $60 billion on lottery tickets ($600 per household annually)

- $100 billion at gambling casinos ($950 per household annually)

- $60 billion on alcohol ($600 per household annually)

- $40 billion on smoking ($400 per household annually)

- $32 billion on spectator sports ($300 per household annually)

- $150 billion on entertainment ($1,400 per household annually)

- $100 billion on education ($950 per household annually)

- $300 billion to charity ($2,900 per household annually)

The priorities of our Boomer led society are clearly born out in the above figures. We spend more eating out than we give to charity. We spend as much on big screen TVs and stereos as we do on education. This may explain why 37 million (12.5%) of all Americans live in poverty and our high school students trail the students of 25 other countries (including Latvia) in science and math knowledge. Our school system processes many more clueless morons who don’t know the candidates for President, versus intelligent, thoughtful, hard working, driven young people. The $160 billion spent on gambling is indicative of the get rich quick without hard work attitude of the Boomer generation. Even worse, households with income under $13,000 spend, on average, $645 a year on lottery tickets, about 9 percent of all their income. Our government feeds this addiction by siphoning off billions in taxes from these gambling revenues to redistribute as they see fit.

What the data proves is that Boomers love to shop and eat, whether they have the money or not. The top 100 retailers in the U.S. have 250,000 stores that generated $1.7 trillion of sales last year. How could America function without 31,000 McDonalds, 35,000 KFCs, Taco Bells, & Pizza Huts, 15,000 Starbucks, 7,000 Wal-Marts, 2,000 Home Depots, 4,000 K-Marts/Sears, and 8,000 Blockbusters? There are 91,000 shopping centers in the United States. The Advertising industry spends $275 billion per year to convince you to spend money you don’t have for things you don’t need. This generation lacks self control, morals, a work ethic, and savings ethic. Based on the recent actions of our government and corporate leaders, we seem to lack any ethics at all. It is immoral for the Boomer generation to run up $53 trillion in unfunded future liabilities in Social Security, Medicare and Medicaid to leave as our gift to future generations, while we live it up today. Optimists like to point out that Europe and Japan have much worse unfunded liability problems than the U.S. That is like taking pride in being the best looking horse at the glue factory. In the end, we’ll all still be glue.

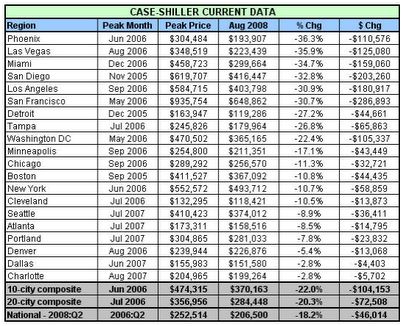

The 25 year Boomer borrowing and spending binge is coming to an end. The hangover will be really bad. The Federal Reserve and Treasury are trying to keep the frat party going, but everyone is passed out on the floor. The Case Shiller housing data shows that the 20 largest cities have experienced an average 20% decline in price from their peaks. The futures index predicts a further 10% to 15% loss in value. There are 75 million owned homes in the U.S. One in six, or 12 million homeowners, owe more than the house is worth. With further expected losses, 20 million homeowners will eventually be underwater on their mortgage. In California, where home price declines will be 40% to 50%, half the homeowners in the State will owe more than the house is worth.

If you are one of these homeowners and can afford the mortgage payment, time will eventually bail you out. If you can’t afford the mortgage payment, you should lose the house to someone who can make the payment. This is the failure side of the creative destruction that is true capitalism. If the government steps in to subsidize and eliminate failure, the system will ultimately collapse.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).