How Did we Get There?

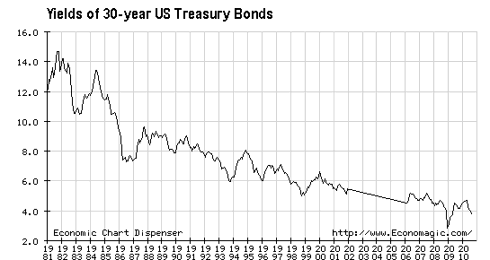

The reason of the present crisis is the secular downward trend of the marginal return on investments as depicted by the chart of the 30 years US Treasury Bonds and the chart of the Yields of 10 Years US Treasury Notes.

When those return on investments were so low as to be below the fair price for interest rate risk banks have started to slow lending and/or made unprofitable investments.

The basic reason for those lower and lower rates of returns was not the absence of credit but a decrease of demand. As long as short-term yields were above zero the Fed could adjust supply and demand by lowering short-term rates. That of course ended when the short-term yields, the target discount rate became at or very close to 0%.

Here comes Quantitative Easing.

Purpose:

The intended purpose of Quantitative Easing is to bring down long-term yields, by lowering the yields of long-term treasuries in order to generate marginal investments.

The first thing we remark is that the crisis we are witnessing today is generated by excess investments in front of a deficit in demand. So bringing down the rates for the borrower is a very intricate scheme. The idea being to generate a sufficient flow of investments which hopefully will trickle down into sufficient demand. that in itself is convoluted. The very fact that demand decreased was due to the fact that not enough of investments trickled down to wages and consumption. Amplifying the phenomenon by tweaking the credit market is intuitively doomed to fail.

Why would you generate more of something you have already too much of? If you are fed up will more food make you more hungry?

In effect tweaking the yield curve has already been done, In Japan during the lost decade (which is 18 years old now) but also by the Fed in the 60's in what was called Operation TWIST. It resulted in a formidable and costly failure which caused the abandon of the Gold Standard.

Chairman Alan Greenspan had a more realistic view of the power of that tool:

Can the right monetary and fiscal policy keep the US out of a recession?

Probably not. Global forces can now override most anything that monetary and fiscal policy can do. Long-term real interest rates have significantly more impact on the core of economic activity than the individual actions of nations. Central banks have increasingly lost their capacity to influence the longer end of the market. Two to three decades, ago central banks were dominant throughout the maturity schedule. Thus, the more important question is the direction of long-term real interest rates.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).