This article is meant to be an update, follow up or more precisely, shamelessly brag on the article I call my closing argument for the market crash -Bonds Hammer Bernanke at Jackson Hole.

This article can be lengthy and sometime boring so I added a wealth of fun videos that help make my point. It is worth reading just for the videos!

Twist!

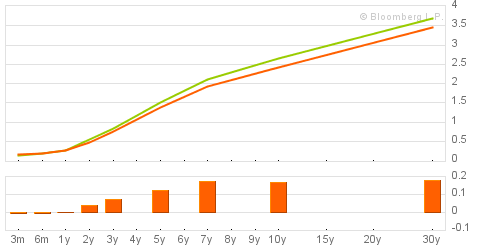

I explained, and this is the basis of all my reasoning for a market crash since the spring of 1994, that long-term yields were undervalued and that they now have reached an unsustainable low level. This is why as a Hammer formed the day before Bernanke speech and rates went up sharply with that speech.

Minimum yield curve (orange) last yield curve on Friday (Green)

That was not based on any economic data or any value of the speech but finding out that there was no more hope in Quantitative Easing and a sharp return toward the fair value of long-term yields.

Those fair values are 4.60% for the Yields of the 30 Years US Treasury Bonds and 3.50% for the Yields of the 10 Years US Treasury Notes.

This new behavior of the yield curve has a major meaning about the short run behavior of financial markets and economy.

Monday September 30th:

I expect an opening for the Yields on 10 Years Treasury Notes around 2.686% (30 Years US Treasury Bonds around 3.732%) and that this gap won't be fully filled which will create a very bullish island reversal.

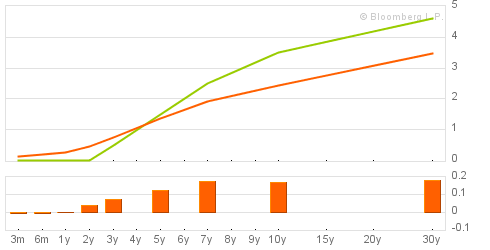

The consequences of that twist of the yield curve will be formidable.

Economic Consequences:

Although the demand for investment necessary to maintain the prevalent level of economic activity is very low, probably less than 2.40% on 10 years (discounted for all the risks except interest rate risks). The offer of funds is higher and will get even at higher rates as the market get closer to the fair valuation of long-term interest rates.

We are witnessing a retreat of savers from long-term investments to cash with a below par level of transaction between the savers and the investors. In term of economic growth it is not so much the price of the transactions that count but rather their volume.

The Economic Outlook and Monetary Policy

Chairman Ben S. Bernanke

At the Federal Reserve Bank of Kansas City Economic Symposium,

Jackson Hole, Wyoming

August 27, 2010

Presents a list of policy options which either have already been used with dismal results or are not even plausible.

Note: for those not familiar with the Fed eggheads lingo, in

"Market expectations for continued accommodative policy have in turn helped reduce interest rates on a range of short- and medium-term financial instruments to quite low levels, indeed not far above the zero lower bound on nominal interest rates in many cases."

"Zero lower bound on nominal interest rates" means "Keynes' Liquidity Trap".

Try that Google Search

What you must know is that the Zero Lower Bound is for 0% short-term interest rate and obviously, as my option model proves, it is higher for long-term yields. So we are not"not far above"but " exactly at".

Of course when you replace "Zero lower bound on nominal interest rates" by"Keynes' Liquidity Trap" it gets a lot more freaky! It means that now matter how much liquidity you inject in the system it won't find its way into the real economy.

My estimate of the purpose of the use of that syntax is that it make it less frightening and you will not find on Bing or Google the amount of research the Federal Reserve System did on the subject since 1994.

Bernanke Says Fed Will Do 'All It Can' to Ensure U.S. Recovery

I am sure "It will do All it Can" the problem is I am also sure 'It' can't do anything!

"The issue at this stage is not whether we have the tools to help support economic activity and guard against disinflation. We do,"

The burden of proof is on him and he didn't describe specific and credible tools. In the meantime I have proved that none of the tools he and his eggheads have envisioned work.

At 1 p.m. on the same day (October 24), several leading Wall Streetbankersmet to find a solution to the panic and chaos on the trading floor.[11]The meeting includedThomas W. Lamont, acting head ofMorgan Bank;Albert Wiggin, head of theChase National Bank; andCharles E. Mitchell, president of theNational City Bank of New York. They choseRichard Whitney, vice president of the Exchange, to act on their behalf. With the bankers' financial resources behind him, Whitney placed a bid to purchase a large block of shares inU.S. Steelat a price well above the current market. As traders watched, Whitney then placed similar bids on other "blue chip" stocks. This tactic was similar to a tactic that ended thePanic of 1907, and succeeded in halting the slide that day. In this case, however, the respite was only temporary.

Over the weekend, the events were covered by the newspapers across the United States. On Monday, October 28, the first "Black Monday",[12]more investors decided to get out of the market, and the slide continued with a record loss in the Dow for the day of 13%.

Since May there have been a sharp disconnect between stock markets and bond markets. As they will necessarily reconnect at some time my estimate is that will take place between the 8th and the 17th of September.

It is very important to understand that these turning points can't be estimated from a macro economic or technical point of view. They can be understood only with an option valuation approach.

Shout!

What do we expect now?

First a fast twist of the yield curve toward its normal stable equilibrium.

These are the yield curves for the minimum on Wednesday (orange) and the expected yield curve on Sept. 7th(green).

Although long dated Treasuries will go down sharply short dated Treasuries (less than 2 years) should get lower and lower yields. It is even possible that some of these yields become negatives.

The spread between corporate and Treasuries will widen fast. Which means that their Credit Default Swap will go up.

Junk Bonds will be worth what they are Junk. (My name is Junk, Junk Bond.)

Commodities and Minerals:

Let me remind you of my article:

Commodity Conundrum Solved: The Hidden Parameter in Interest Rates

(Please don't read the update it is a BS I wish I never wrote)

The conclusion is that on Sept. 9th will start a sharp drop of the prices of minerals including oil, gold, silver, copper...

Stock Market:

It is very probable that during the next 10 days till Sept. 7th it will exhibit an acute bout of irrational exuberance bringing the SP500 above 1130! As a consequence the implied volatility on stocks and stock indices [VIX] should be going down.

What we Need to Watch:

Apart from the fall of long dated Treasuries asharp decrease in short term Treasuries Yields (With a term below 2 years that could possibly become negatives.)

We have also to look closely on both the Ted Spread as banks will come to realize that trading with each other is not that safe after all and the infamous Credit Default Swaps. Expect an sharp increase of the insurance premium from now on.

Finally and apart from the normal flux of macro economic figures (especially unemployment data):

We must watch the auction of 10 Years US Treasury Notes on September 8th,which I expect bad, and especially the auction of 30 Years US Treasury Bonds on September 9th, which I expect to be dismal.

Friday Sept 10th, after the close, the number of failed banks as published by the FDIC.

Bragging:

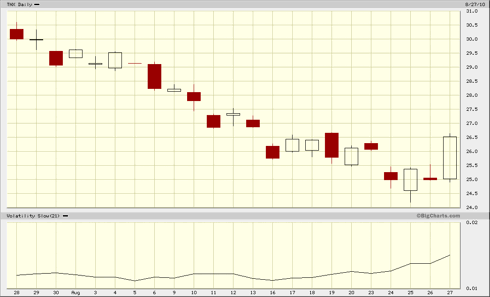

Yield on 30 US Years Treasury Bonds: Bottom: 3.462% on Wednesday, Last 3.698%.

Yield on 10 Years US Treasury Notes: Bottom 2.419% on Wednesday, my Buy Call:4.249%, Last: 2.652%. Paper loss for a little bit less than 5 Hours, not bad (bragging :) )

TED Spread minimum: 1.54% for the laston Wednesday. Last: 1.59%.

Anecdotes:

The Hindenburg Omen:

This is a buzz on Wall Street now:

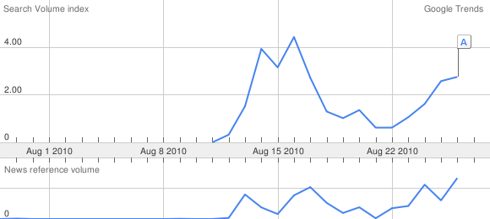

Google Trend for Hindenburg Omen

Yes Folks, Hindenburg Omen Tripped Again from the Wall Street Journal.

Hindenburg Omen on Wikipedia

Mixed Signals and the Hindenburg Omen from Forbes

Note that 40 days after the first occurrence of the Hindenburg Omen is September 21st.

Labor Day:

September 6th, 2010.

Labor Day brought the summer of 1929 to its conventional end on September 2. The next day the New York Stock Exchange had near record volume of 4,438,910 shares - The market was strong with what the press called a good undertone. On this very day, September 3, 1929 - as if by common consent - the great bull-market of the 1920s came to an end. In the days that followed, stock prices see-sawed under increasing volume as professional market veterans sought to unload.

The Quadruple Witching Hour:

September Friday 17thfrom 4:00 PM EST to 5:00 PM EST is Quadruple Witching Hour, which is prone to high volatility.

Triple witching houris the last hour of the stock market trading session (3:00-4:00 P.M.,New York Time) on the third Friday of every March, June, September, and December. Those days are the expiration of three kinds of securities:

The simultaneous expirations generally increases the trading volume of options, futures and the underlying stocks, and occasionally increases volatility of prices of related securities.

On those same days in March, June, September, and December,Single-stock futures also expire, so that the final hour on those days is sometimes referred to as thequadruple witchinghour.[1]

Rosh Hashana and Yom Kippur:

There is a say on Wall street: "Sell at Rosh Hashana, buy at Kippur." well bad luck: this year Rosh Hashana fall on September 9th, the day of that dismal 30 Years US Treasury Bonds auction and Yom Kippur fall on a Saturday immediately after the Quadruple Witching Hour. It will be difficult to buy on a Saturday, won't it?

This year Erev Yom Kippur, falls on Sept 17th, 2010 or9thof Tishrei, 5771, 911!

Eidal-Fitr (Arabic: Ø �Ù?Ø � Ø �Ù?Ù �Ø �Ø � 'Ä �du l-Fia' � r� ??)

The Eid (the sacrifice that marks the end of Ramadan) will fall (approximately) on September 10th - 13th.

For us economists holidays are a way to coordinate the economic activities of those who celebrate as well as those who don't. (confer Christmas for Christians, Passover for Jews,Indian marriage season,...)

You might not believe these urban legends but your opinion or mine are irrelevant to the stock market. What counts is what the average opinion believes the average opinion will be. This is what you want to discover:

In one of the greatest investment markets in the world, namely, New York, the influence of speculation (in the above sense) is enormous. Even outside the field of finance, Americans are apt to be unduly interested in discovering what average opinion believes average opinion to be; and this national weakness finds its nemesis in the stock market.

As I have explained since May on the event "MarketCrash: be Prepared" on Facebook which with 9 days to go has 479 participants:

Don't own any long term assets:

------------------> from September 09th, 2010 at 9:00 AM EST.

------------------> till September 17th, 2010 at 4:00 PM EST.

Long-Term Assets:

Long-term assets are anything you own which is not directed to your own day to day consumption: businesses, Stocks, debt instruments, real estate, and commodities including gold or silver.

The proceeds must be held either in cash or invested in short-term Treasuries (maturing in less than two years and held with the emitting treasuries. (With Treasury Direct for the US Dollar.)

No holding must be deposited with any bank.

Best day to sell businesses, real estate and bonds: ASAP.

Best day to sell minerals: Sept 6th.

Best day to sell stocks: Sept 7th.

Playing the Market Crash:

Options on Stocks and Single Stock Futures:

Given the date of our planned market crash it can be played in a very simple and cheap way:

From the September 1stto September 17that the open buy out of the money up to 100 points out for SP500!) put on stock index traded on any American market with an expiration date on September 17th at 5:00 PM EST or later. Being so close to the expiration their price will be ridicule even if VIX is high nowadays: it is all a question of timing!

Why not a later term for options?

We must beware when we trade on an exchange our counter party is the exchange. With a sharp downfall of the market it is very possible that a large proportion of the buyers couldn't make good on their contract so the exchange itself could be bankrupt this is why I recommend not to be greedy and take your money out of the exchange as fast as possible after Sept. 17th at 5:00 PM EST and put it in the safest vehicle on earth Treasuries with a term not longer than 2 years deposited with Treasury Direct.

Paying for a high implied volatility price is not the problem in that case. For most of us the transaction price will be even bigger thanthe cost of the option.

Anyway I expect VIX to trend downward from now till Sept. 7th.

Options on Minerals:

My preferred is without contest Gold!

Buy out of the money puts on Sept 6th- 7th. (The 6ththe market is opened in London!)

Deus in Machina

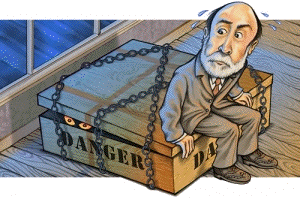

Chairman Ben Shalom Bernanke ticking bomb: 9, 8 ... 1, 0

Conclusion:

Our Facebook Page "The Post Crash Economy" has 373 fans.

Our Facebook Group "Prepare for Market Crash Before September 9th." has 84 members.

Economic Consequences:

On Sept. 22nd, as we will have exhausted all of our other options, I will, on "Market Crash: be Prepared" start to display a series of videos in which I will present my alternative to the Deep Depression as a way to limit its chaotic social, political, military consequences.

Eid Mubarak"History teaches us that men and nations behave wisely once they have exhausted all other alternatives".

Shana Tova U Metuka

Disclosure: No Positions