Risk management involves judgement as well as science, and the science is based on the past behavior of markets, which is not an infallible guide to the future.

Yield Curve:

If we had added that information that is include some information about the shape of the yield curve at the moment of the occurrence we would most probably have eliminated most of these false signals.

I have not the tools to reexamine these false signals I am sure some will.

In any way the present shape of the yield curve show that long-term yields are very undervalued and I would say extremely undervalued compare to what I estimate being their fair value.

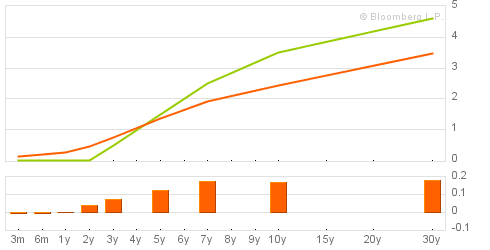

These are the yield curves for the minimum on Wednesday (orange) and the normal yield curve on Sept. 17th(green).

But what they perceive as newly abundant liquidity can readily disappear. Any onset of increased investor caution elevates risk premiums and, as a consequence, lowers asset values and promotes the liquidation of the debt that supported higher asset prices. This is the reason that history has not dealt kindly with the aftermath of protracted periods of low risk premiums.

At this stage any random shock could trigger a normalization of the yield curve and mechanically create a sudden decrease of the present value of stocks:

For example given the value we got on last Wednesday the present value of the SP500 assuming no change of the expected incomes would give, using the Fed model:

By mechanically increasing the Yield of US Treasury Notes from 2.419% to 3.500% and before any economic positive feedback the fall of the SP500 will be ... 31% !!!

The first step will be at around 719 not far from the famous previous low of 666.

That low number doesn't take into account the positive feedback of its macro economic consequence, which I have proved will be tremendous.

Next Possible Occurrence:

The first manifestation of the Hindenburg Omen was on a 30 Years US Treasury Bond auction. The next one is on Sept.9th.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).