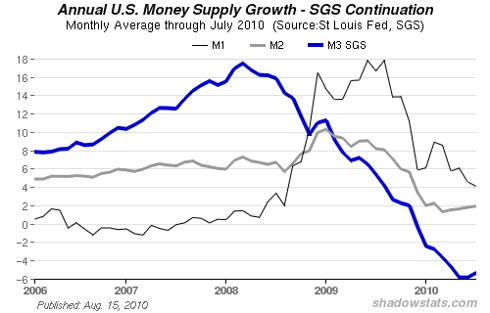

The yield curve necessary to sustain our sluggish economy is the green one, the yields that will be required by investors to reward them for interest risk is the orange one. As we can see the gap will be such that there will be a sharp decrease in the level of investments from the prevalent low. We can see how insufficient it is already by watching the year to year change in M3.

Bond Market:

Of course that will be even worse for bonds that are rated below investment grades and the demand for junk bonds will vanish all together.

Real Estate Premium Near Record to U.S. Bonds Signal Time to Buy Property

Mortgage Bonds Lose Ground as Homeowners Grab Lower Rates: Credit Markets

Corporate Default Swaps Head for Biggest Monthly Rise Since May in Europe

Asia-Pacific Bond Risk Rises, Credit-Default Swap Prices Show

TED Spread:

We can see that the TED spread has started to increase after falling since mid june has started to go up on... wednesday 25th, August!

Stock Market:

By the simple application of actualization formula we can see that mechanically the SP500 as the yields of the 10 Years US Treasury Notes jumps from 2.419% to 3.500% the SP500 would go from 1040 to 719 (1040 * 2.419 / 3.500), without of course taking in account the effect on consumption employment and investment that will necessarily feed back on the fall.

Warning: because the steepening of the yield curve will probably, at first appear as a better outlook for the economy we will probably witness a bull run till Sept. 7th. In traders lingo it is called a bear trap. Don't fall in it! Take advantage of that bull run to sell the market wisely.

The Yield Curve as a Leading Indicator by... The Federal Reserve Bank of New York!

Minerals:

As I have shown in my article Commodity Conundrum Solved: The Hidden Parameter in Interest Rates when the yield curve is normal or steep the prices of mineral returns quickly to their marginal cost of extraction.

For gold it is below $300 a fall of 76% with an overshoot as, of course, the gold that is stored outside the ground has, by definition a cost of extraction = $0.

For oil that marginal cost of extraction is below $20 and probably closer to $10, which means an immediate fall of 74%.

Those percentage don't take into account the rise of the price of these minerals from now till Sept 17th.

These figures are bare minimums as with demand and cost going down the marginal cost of extractions will necessarily go down too.

Before the curve returns to normal the price of minerals will continue to go up.

Quantitative Easing Again?

The astute reader may ask if it is possible by a further round of Quantitative Easing to prevent that state of affair.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).