How did Fannie and Freddie lose so much money? There are many reasons, but the two most important ones are Alt-A and interest-only loans, which generated most of the losses. These are not products for low or moderate-income borrowers. But they are products that invite fraud. Reports by the Federal Housing Finance Agency and the St. Louis Fed lay it all out in context. Once again, we see how the root causes of the real estate bubble are traceable to interest rates and fraud.

Interest Rates: Greenspan's Boom/Bust Cycles

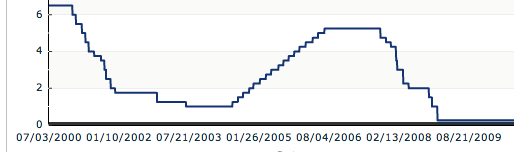

The chart below from the St. Louis Fed is one of the best illustrations anywhere of how Fed policy creates predictable boom/bust cycles in the mortgage lending business. It could be titled, "What Alan Greenspan Wrought."

Since the 1980s, lenders have benefited from booms caused -- not by loans for new home purchases, which rose steadily year after year -- but by refinancing waves caused by drops in mortgage rates. Each ensuing bust, or sharp drop in refinancing volumes, began after rates started rising, or after everyone who wanted to refinance had already done so.

The chart illustrates two successive boom/bust cycles. The first applied to Fannie and Freddie (the Agencies), which specialized in 30-year fixed-rate loans. There was a 2001 - 2003 boom, when 90% of the GSEs' loans were fixed-rate. "Between 1971 and 2002, the fed-funds rate and the [fixed] mortgage rate moved in lockstep," wrote Greenspan. On December 31, 2000, the fed-funds rate was 6.5%. Six months later it was 3.75%. By year-end, it was 1.75%. He triggered the biggest refinancing boom in history, which accelerated when he slashed the Fed Funds rate to 1.25% in November 2002. At the end of 2000, America had $5.1 trillion in single-family residential mortgage debt. During 2001- 2003, $6.1 trillion had been refinanced (page 21 of Greenspan's study) .

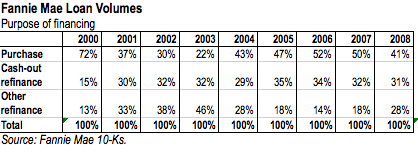

During the ensuing bust of 2004 - 2006, the GSEs' loan volumes fell by more than 60%. The dropoff could have been worse but for the spike in cash-out refinancings, which were rationalized by rising real estate values. Fiscal year 2000 was the last time that a decisive majority of Fannie's loans were extended for home purchases. It was more a matter of people using their homes as piggybanks, as opposed to people buying homes they couldn't afford. It was a phenomenon that Greenspan followed closely.

Subprime/Alt-A and ARMs

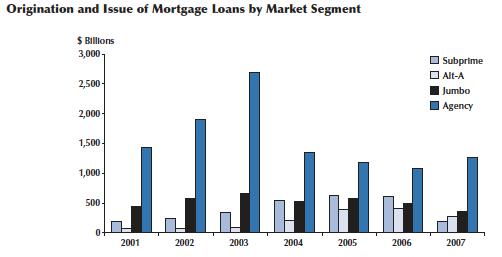

The second cycle, which applied to subprime and the Alt-A loans, began with a 2004 - 2006 boom. The subprime/Alt-A bust began in 2007 and continues into the indefinite future. This was the first-ever boom tied to short-term interest rates. The St. Louis Fed, tracking the data on mortgage securitizations, shows how in 2004, for the first time ever, the majority of Alt-A originations were ARMs. Over three-quarters of subprime loans were ARMs, with the lion's share subject to reset after three years.

Greenspan promoted the second refinancing boom, both by continuing to reduce short-term rates after fixed-rate mortgage pricing flattened out in 2002, and by promoting ARMs. "Alan Greenspan said Monday that Americans' preference for long-term, fixed-rate mortgages means many are paying more than necessary for their homes and suggested consumers would benefit if lenders offered more alternatives," wrote USA Today on February 24, 2004.

But ARMs blow up.

ARMs are much riskier than fixed-rate loans. Their failure rate shoots up whenever interest rates rise. Lew Ranieri, who invented mortgage securitizations and warned regulators and the rating agencies about reckless lending practices five years ago, explained the problem with ARMs last August, at lunch meeting hosted by Treasury and HUD to discuss, "Funding Housing and the Role of Securitization." he said:

I can give you a history of how many different types of floating rate loans we tried simply because the market wants more floating rate than it wants fixed. Every one of them blew up until Jim Montgomery created the California ARMs with caps and a floor. We never had a floating rate that didn't blow up on us. And that one is only a collar. All of these other structures that we have now never stood the test of time. You have nothing to prove to me that it's not going to blow up in your face.So the only structure that we know that has stood the test of time, when they don't monkey with it, is the 15-year self-amortizing and the 30-year and the Jim Montgomery [coffee?] ARM, although that's only a collar. So when there are violent interest rate moves it gets kind of scary.

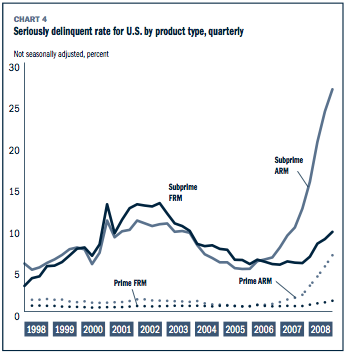

So as surely as the sun sets in the west, ARMs started defaulting after the fed-funds rate moved upward and their initial teaser rates were reset. In May 2004, the fed-funds rate was 1%. In May 2006, the fed-funds rate was 5%. Viola. Delinquencies among all ARMs spiked. By June 30, 2008, the rate of serious delinquencies among subprime ARMs was five times what it was three years earlier, according to the Mortgage Bankers Association. Serious delinquencies among prime ARMs had increased more than tenfold over the same period.

Source: Mortgage Bankers Association

Fraud: Government Policy to Keep the GSEs Out of Subprime

"Evidence indicates that the vast majority of mortgage fraud and predatory lending activities -- including excessive fees, provision of credit life insurance and prepayment penalties -- occurs in the conventional subprime lending market," said HUD Secretary Andrew Cuomo in 2000, citing a joint HUD/Treasury study on the topic. So the Clinton Administration drafted regulations to shut Fannie and Freddie out of the segment of the subprime market dominated by Wall Street securitizations. Cuomo wanted to go further, and lobbied for legislation to categorically prohibit many subprime lending practices. But at the end of the day, his influence only extended to the GSEs. Phil Gramm prevented any legislation from moving forward, and Alan Greenspan, who had the authority to oversee and regulate the mortgage lending business, continued his steadfast policy of refusing to do anything.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).