Why is today's dollar bill like a mini-subprime mortgage? Because the "UNITED STATES OF AMERICA" caption on both sides, the picture of George Washington and signatures of the "Secretary of the Treasury" and "Treasurer of the United States" on the front, and the "Great Seal of the United States" set symmetrically in green lace on the back; all these, in conjunction with misleading language in the1913 Federal Reserve Act, reflect a design to win the controlling votes of Greenbackers and satisfy the public by inducing belief that the act restored the original Lincoln greenbacks ; [1] whereas, the small-print "Federal Reserve Note" in the front's top margin is all that counts.

However, today's dollar bill not just another national bank note. The 1913 act institutionalized it as a private-bank monopoly, backed by the nation's credit. In 1971, when Nixon took the U.S. off the international gold standard, the Treasury had been redeeming notes in gold, not the Fed. Now, as a fiat currency, the Fed garnishes the face-value of each note as a flat tax paid upon issuance. The Fed pays the Treasury only the printing cost, which is about seven cents per bill.

Each bill enters circulation the only way allowed under the law, by a bank lending it at interest. Got it? Banks are automatically owed more dollars than there are dollars in circulation. One man's wealth is many men's poverty, as a matter of arithmetic finality. Assuming the moral high ground, banks of course demand full repayment, even when and where they have taken back money, absolutely reducing the amount locally available. Those not bankrupted, evicted, prosecuted, or blackballed for perforce coming up short, are merely fleeced. A chorus of baa-baas follows the Fed. Beware of the sheep.

Federal Reserve notes are owned by the Federal Reserve. The Federal Reserve is owned by the owners of the banks that de facto govern the Fed's Board of Governors, which cannot govern the banks except in strictly limited circumstances, under unitary free market doctrine. [2]

United States notes are owned by the United States. The United States is owned by everyone.

What the Fed owns, everyone else owes. What the United States owns, everyone owns.

2. Same Old Normal

"Hong-Kong-Cayman!" "King-Kong pay, man!"

[Wall Street. Contemporary "high-five.']

Main Street. You're struggling to pay off a credit card. A new credit deal sounds better. You ask your banker to tell you the short and long term costs and benefits of the change. After running the numbers, he tells you there's no point in changing, because you'll wind up with exactly the same monthly payments. You stay put" Your debt rises... You keep hearing good things about that new deal, and make your banker rerun the numbers. Same result" Twenty-one years, and what do you get? Another day older and deeper in debt, you discover that those same monthly payments would have paid off the debt ten years ago, and you'd have been saving money ever since!

Your banker failed to tell you that those "same" monthly payments included big principle reductions, and no fees, whereas the payments that he continued to recommend would grow your debt forever, with 81.5% consumed as fees! You confront him. He tells you that there's no net benefit to you if you change. It's not just monthly payments that are the same. The money you think to save by moving it, exactly equals what your present lender will lose. This loss will be charged to you, and so your net gain is zero. You'll always be in debt, that's a given, he says. But thanks to him, there's been no problem rolling over your growing debt. You're in no position to disagree now, are you?

However, he adds, enough is enough. He's been very patient with you. You need to start selling stuff, or you'll be hit with bankruptcy, foreclosure, unemployment, and undischargeable lifetime penalties. He tries to get you feeling guilty, for living above your means irresponsibly, for far too long. You frown. Your debt is a fact you can't deny. He confidently continues to bluff. "You don't get it, do you?" [Patient sigh, shaking head.] "What you call debt is accrued on your own credit card. Look! The account is in your name! Yours! It's all a wash!"

You wonder, can he take you for such a perfect idiot? Well, yes. He already has, for many years, hasn't he?

Come to think of it, he has your current account, and has lent 85% of it to someone in Honk Kong. Your hard earned wages. On the other hand, every month your $5,000 savings account grows. He added $0.83 to it in interest payments last month. Aren't you grateful he's looking after your money for you?

* * * *

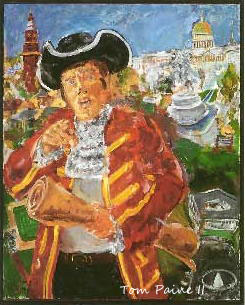

Pennsylvania Avenue. As memorialized in five GAO reports spanning 21 years, [3] estimating the net benefit to the government of replacing $1 dollar Federal Reserve notes with $1 United States coins, that's precisely how the Treasury and Fed have managed to stave off a national "greenback" teaching moment -- the could-be tipping point, after which the nation's idiotic servility to the parasitic Monied interest [4] would become generally recognized.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).