"Name and address of the person or business you are reporting.

"Identify

the type of asset that was concealed and its estimated dollar value,

or the amount of any unreported income, undervalued asset, or other

omitted asset or claim." US Trustee Program

The Bank Leaves out Documentation Critical to Lawful Approval of their Claims against You

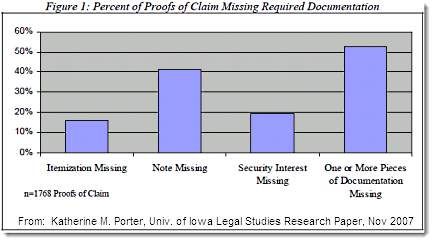

Kathleen M. Porter published a landmark study on bankruptcy court in

2007. Porter's research team reviewed 1700 bankruptcy rulings from

federal courts across the country. Porter found that required

documentation was missing in just over 50% of the cases from the

extensive sample.

From, Misbehavior a by Katherine Porter

From, Misbehavior and Mistake in Bankruptcy Mortgage Claims, Katherine M. Porter, November 2007 p. 18

Professor Porter commented on this failure to comply with documentation requirements:

"Without

documentation of the debt, the debtor and other creditors cannot verify

the legitimacy or accuracy of claims, each of which cuts into the

limited dollars available for distribution. Poor compliance with the

claims rules effectively deflects creditors' obligations onto

cash-strapped bankrupt families, who must choose between the costs of

filing an objection or the risks of overpayment." K.M. Porter, 2007 p. 36

Porter's research confirmed that only a minority of bankruptcy courts use incomplete documentation to disallow creditor claims. The failure to require proper documentation distorts over 50% of settlements. How can a bankruptcy judge set amounts owed, etc. without knowing the basis for such judgments?

The creditors with the special right to accuse you of fraud get away with filing flawed claims against you. Are their cases dismissed for errors? Hardly ever, according to the study.

You had no idea that the creditor clams were incomplete thus legally flawed. Neither the court nor your lawyer noticed.

There are Creditor Fees that You Don't Understand

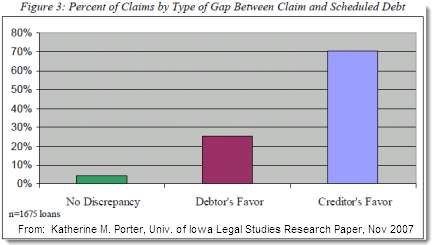

The paper chase of bankruptcy often times produces conflicting claims about amounts due. Debtors face tremendous pressure to readjust their entire lives to cope with impending financial doom. The graph below shows that creditors are much more likely to state claims in their favor than are debtors.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).